In the ever-evolving quest for financial stability, retirement dividend investors are consistently on the lookout for stocks that not only offer appealing yields but also possess a robust track record for dividend growth. Among such opportunities, one standout large-cap Integrated Utilities stock has reaffirmed its position in the prestigious Best Dividend Protection Stocks model portfolio. With a forward dividend yield of 4.43%, surpassing the industry average of 4.1%, this stock represents a compelling option for those seeking to fortify their investment portfolio against market volatility. Notably, its dividend has seen a steady increase over the past nine years, placing it in the upper echelon of dividend stocks for potential future growth.

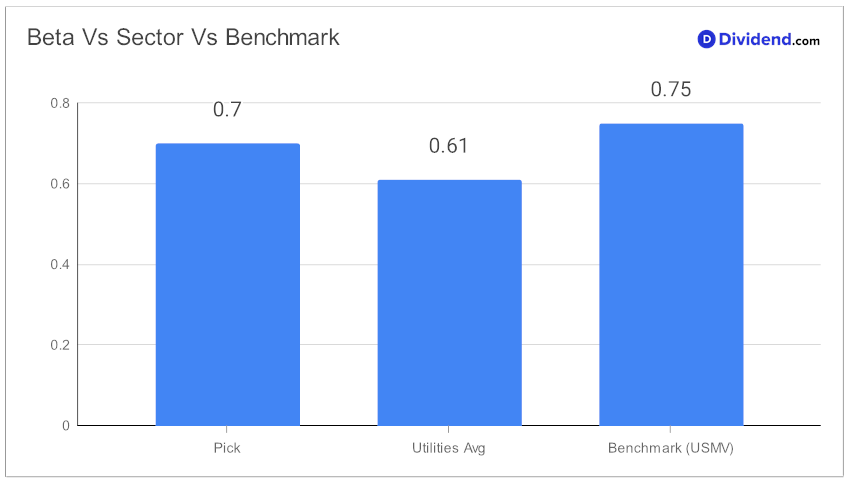

Additionally, its low beta of 0.70 indicates a lesser correlation with the broader equity markets, offering an attractive diversification benefit.

Investors will be particularly interested in the upcoming dividend payout, estimated at $1.130 per share, slated for distribution around April 10.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 23, 2024. The utility company reported a successful year with an adjusted earnings per share (EPS) of $6.77 for 2023, reflecting solid financial results and strategic growth. The company secured significant new electric service agreements, adding over 1.3 gigawatts of generation capacity, driven by investments across diverse sectors. Operational excellence was highlighted by improved outage rates and efficiency gains.

Looking ahead, the company plans to invest $20 billion over the next three years in sustainable energy solutions, projecting an adjusted EPS guidance range of $7.05 to $7.35 for 2024, with steady growth expected through 2026. This outlook underscores a commitment to enhancing stakeholder value through strategic investments and operational improvements.

This selection process, prioritizing dividend safety and minimizing returns risk, with a keen eye on yield attractiveness and returns potential, underscores the careful analysis driving this recommendation. The following in-depth analysis will delve deeper into why this stock is a linchpin for investors seeking to enhance their dividend income streams while safeguarding against market unpredictability.