In a landscape where secure and growing dividends are more precious than ever, a well-covered mega-cap stock from the Health Care Facilities Services industry has caught the attention of savvy retirement investors. With a modest 24% forward payout ratio, this selection not only aligns with the sector’s average but also stands out for its robust 14-year track record of dividend growth—a metric placing it in the elite top 10% of dividend-payers. What’s more, its three-year dividend growth rate shines in the top 40%, promising a blend of stability and growth.

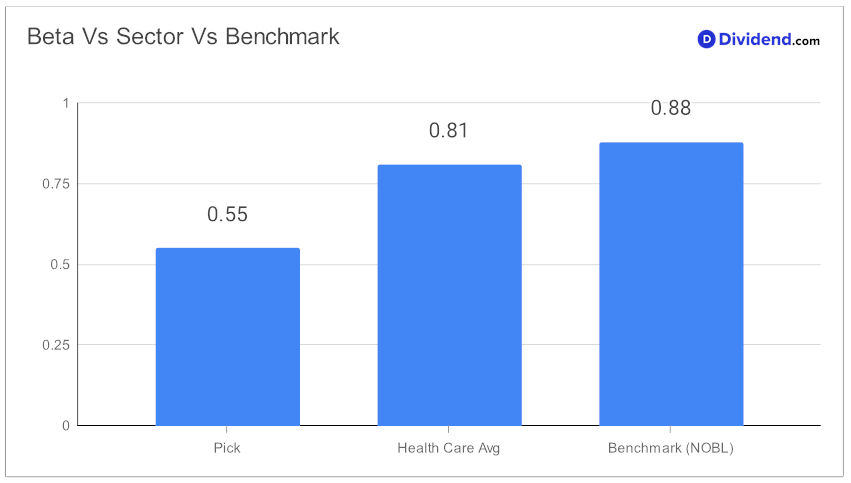

Notably, its low beta of 0.55 signals a unique opportunity for portfolio diversification, offering reduced correlation to broader equity market fluctuations.

The next payout, estimated at $1.880 per share around June 7, underscores the tangible rewards of holding such a stock.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 12 Jan, 2024. The healthcare services provider, with significant operations in insurance and healthcare provision, reported a year of sustainable growth despite challenges such as changing senior care activities and reduced Medicare Advantage funding. The company emphasized its expansion in value-based care, servicing more patients, and notable revenue growth across its divisions.

Future strategies focus on enhancing healthcare accessibility, quality, affordability, and leveraging digital technologies for efficiency. Company management remains optimistic about growth, particularly in Medicare Advantage, despite funding pressures. The financial outlook is strong, with substantial investments planned for digital health and value-based care initiatives. The company’s robust cash flow from operations supports significant shareholder returns through share repurchases and dividends, signaling confidence in its long-term growth trajectory.

This inclusion in the Best Dividend Protection Stocks model portfolio is not merely about immediate gains but a strategic choice optimized for dividend safety, return risk management, and attractive yield potential. For those poised at the juncture of retirement, delving deeper into this analysis could unveil strategies to fortify your income stream against the unpredictable tides of the market.