In the ever-changing world of investments, dividend protection remains a cornerstone for those eyeing a stable retirement. Imagine a financial services stock that not only aligns with the institutional financial services industry average but stands out as a superior dividend protector. With a low forward payout ratio of just 23%, compared to the industry standard of 36%, this asset offers a sustainable dividend policy, mitigating risks associated with high payout stocks.

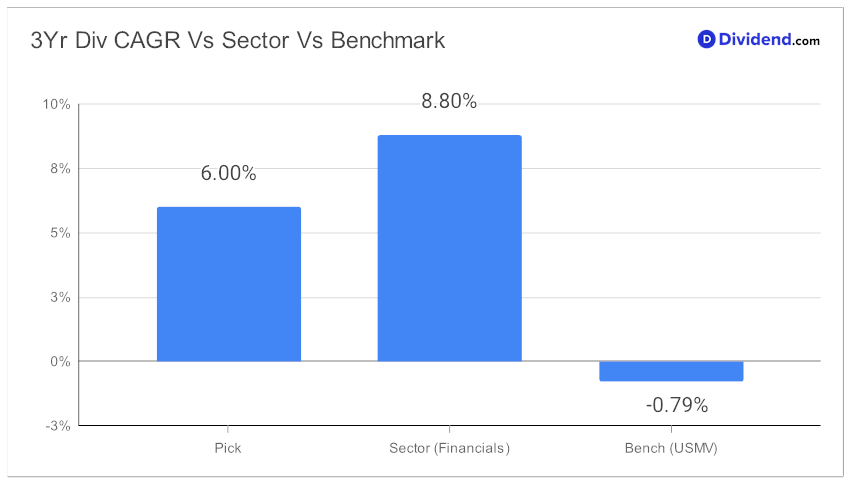

What’s more enticing is the company’s enviable track record of dividend increases for 31 consecutive years, positioning it in the top 10% of dividend stocks. Additionally, the stock features a decent pace of dividend growth, with 6% compounded growth seen annually over the last 3 years.

Even though it’s year-to-date returns are 4%, slightly underperforming the S&P 500 at 17% and the institutional financial services industry at 5%, its solid dividend history offers a cushion against market volatility.

As for immediate cash flow, investors can look forward to an estimated next payout of $0.430 per share, expected around December 5.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on July 27, 2023.

The stock’s performance and future prospects have been thoroughly analyzed, optimizing for Dividend Safety and Returns Risk, and to a lesser extent, Yield Attractiveness and Returns Potential. The comprehensive in-depth stock analysis that follows dives into these factors in detail, allowing you to make an informed decision for your retirement portfolio.