In the realm of retirement investing, where stability often trumps speculation, one mid-cap stalwart in the Institutional Financial Services sector continues to underpin portfolios with its exemplary dividend record. Boasting a modest forward payout ratio of 23%, this company stands as a paragon of dividend reliability, aligning closely with the industry average. Its 32-year history of consistent dividend growth not only positions it in the elite decile of dividend stocks but also signals robust future prospects.

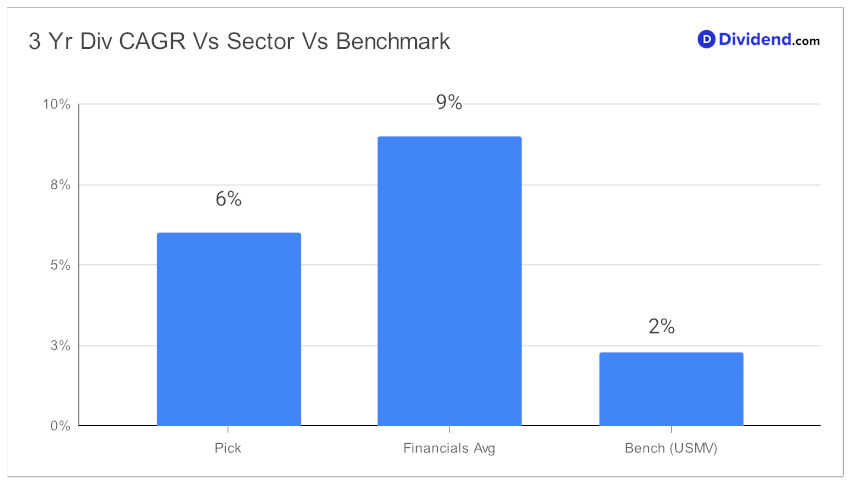

Investors marking their calendars for the next payout can anticipate a healthy $0.430 per share disbursement on the horizon, come early December. This financial beacon has been a fixture in the Best Dividend Protection Stocks model portfolio, carefully vetted for dividend safety and return risk, while also factoring in yield attractiveness and return potential. Meanwhile, it’s 3-year cumulative dividend growth stands at 6%, which is lower than the broader financials sector but is better than this portfolio’s benchmark.

The ensuing analysis will delve deeper, unraveling the nuances of this stock’s performance and offering insights into its long-term potential. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 25, 2023.

For those curating a retirement portfolio that prizes both dividend fortitude and growth, the forthcoming exploration is an indispensable read, illuminating the path to informed investment decisions.