As retirement dividend investors, you’re likely always on the hunt for stocks that offer both safety and attractive yields. There’s good news. A fresh addition to the Best Dividend Protection Stocks model portfolio stands out as a well-covered large-cap in the Chemicals sector.

With a 32% forward payout ratio, this new holding is not only fiscally conservative but also matches the Chemicals industry average. It’s worth noting that this stock boasts a staggering 49-year dividend increase track record, placing it in the top 10% of all dividend-paying stocks. Expect future hikes in the dividend as well.

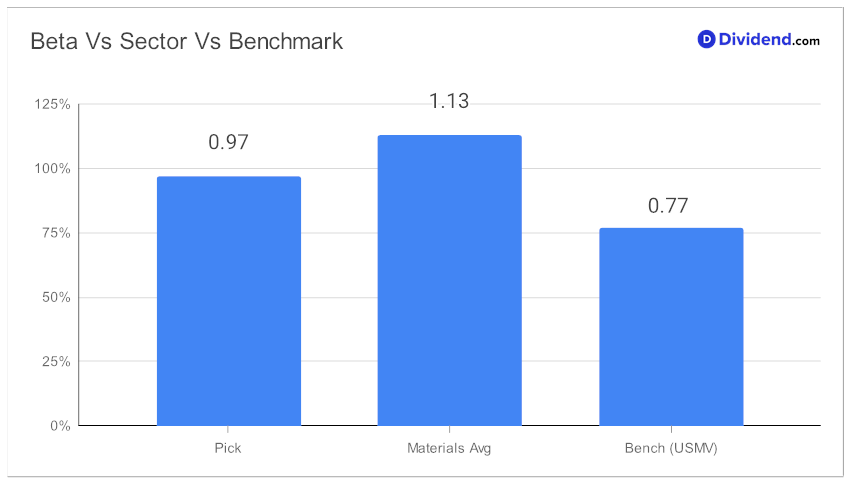

While it may not have dazzled with year-to-date returns, posting 2%— the same as the broader Chemicals industry but trailing the S&P 500’s 14%—its next payout is promising. Scheduled for next Tuesday, October 17, the dividend has been bumped up by an impressive 9.5% to a qualified $0.460 per share. Additionally, the stock features a beta of 0.97, which indicates volatility in line with the overall market, but is better than the sector average.

While coming up with the recommendation, we’ve taken into account the growth drivers and financial results discussed by the company management during their Q1 2024 earnings call held on October 5, 2023.

Keen to know more? The in-depth stock analysis that follows will delve into various facets, focusing on dividend safety and returns risk, while also touching on yield attractiveness and returns potential. Stay tuned!