In the ever-evolving landscape of retirement investment, one standout mid-cap equity REIT has caught the eye of savvy investors, earning its place in a prestigious model portfolio renowned for prioritizing dividend safety and return risk. With a forward dividend yield of 5.51%, it not only surpasses many in the realm of high-yield opportunities but also carefully avoids the pitfalls of dividend traps—a noteworthy achievement given the industry’s average yield of 5.6%.

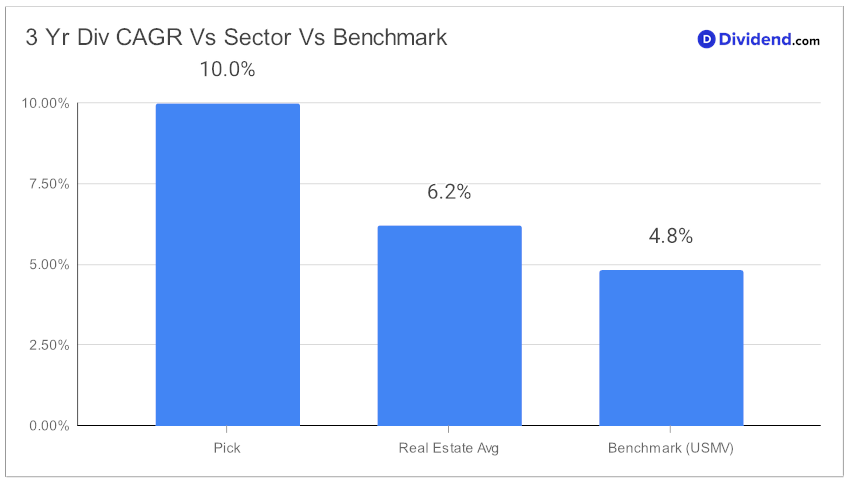

What sets this entity apart is not just its attractive yield but its impressive history of dividend growth, boasting a 30+ year track record of increases that places it in the elite ranks of dividend-paying stocks. This consistency, combined with a 10% three-year dividend compound annual growth rate, underscores its potential for future growth, making it a beacon for retirement dividend investors looking for both stability and growth.

Investors can anticipate the next payout, an estimated $0.565 per share, around April 12, a testament to the company’s commitment to shareholder returns.

This introduction serves as a gateway to a more detailed analysis, offering insights into why this REIT stands as a cornerstone for those optimizing their portfolios for dividend safety, yield attractiveness, and return potential. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 9, 2024.