In the realm of retirement investing, stability and consistent income are key. A standout large-cap eREIT has recently caught the attention of savvy investors, particularly those focusing on dividend income. With a forward dividend yield of 4.48%, it not only offers a solid return but also stands well above many of its peers, although slightly below the industry average of 5.6%. What truly sets this entity apart is its remarkable 14-year track record of dividend increases, positioning it in the upper echelon of reliable dividend-paying stocks.

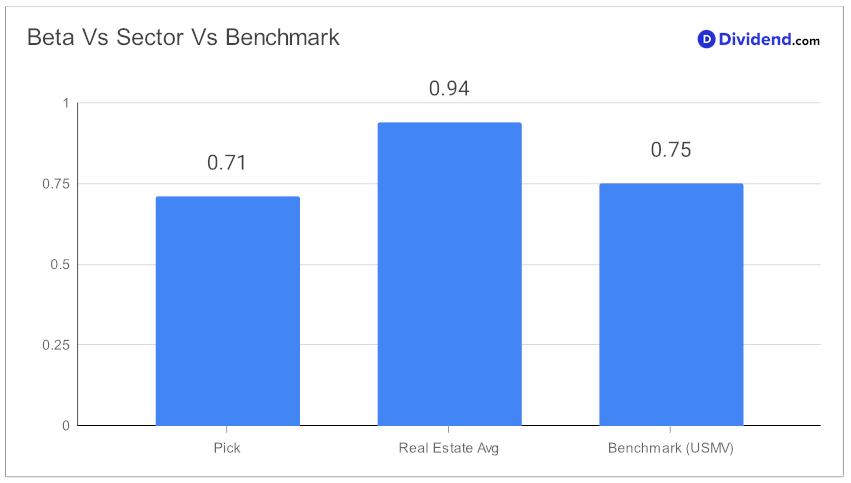

This eREIT’s performance is further underscored by its 12% 3-year dividend compound annual growth rate (CAGR), making it an attractive option for those seeking growth in addition to income. Moreover, its low beta of 0.71 indicates a lower correlation with broader equity market fluctuations, offering a diversified risk profile for investors’ portfolios.

The upcoming dividend payout, estimated at $0.510 per share on or around February 22, is just one example of the tangible benefits it offers to shareholders.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on March 5, 2024. The company, operating within the storage sub-industry within the real estate sector, reported solid operating results amidst a challenging economic landscape. The management noted a stabilization in operating trends after a volatile year, with urban markets, particularly New York City, demonstrating resilience and outperforming others. Additionally, the tight housing market and a competitive environment have heightened customer price sensitivity, yet customer retention remains strong.

Looking ahead, the company is poised to leverage its robust financial position to navigate market uncertainties, with management’s guidance for 2024 reflecting cautious optimism amid projected growth.

Our comprehensive analysis delves deeper into why this stock not only promises dividend safety and attractive returns but also how it fits into a well-rounded investment strategy aimed at optimizing both yield attractiveness and potential returns.