As savvy retirement investors constantly seek to fortify their income streams, the latest addition to the Best Dividend Protection Stocks model portfolio emerges as a compelling prospect. This well-covered mega-cap Biotech/Pharma stock stands out with its robust 3.88% forward dividend yield, surpassing the industry average and positioning itself in the top 40% of dividend stocks. Not just a fleeting opportunity, it boasts a remarkable 50+ year track record of dividend increases, hinting at a stable and growing income for future retirees.

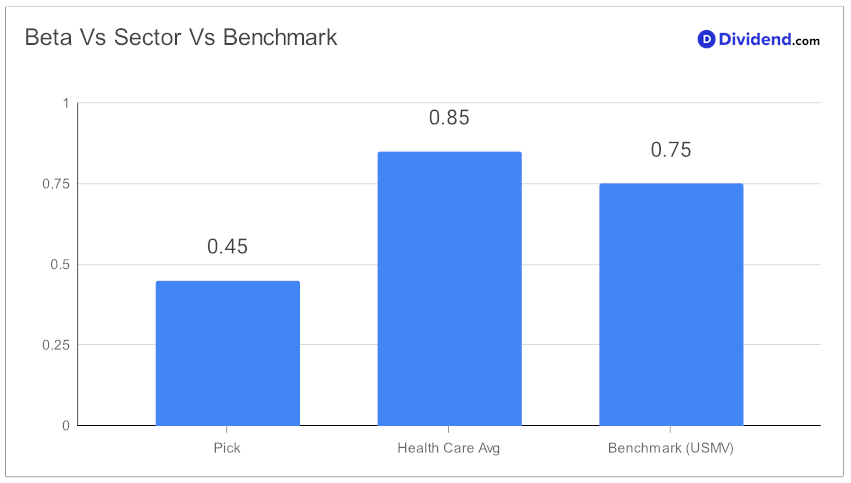

In an ever-volatile market, this stock’s low beta of 0.45 promises a haven of stability, ensuring that your returns aren’t fully at the mercy of market swings, thus diversifying your equity portfolio effectively. Mark your calendars for the imminent reward – a 4.7% increase in dividends, going ex-div on the upcoming January 12th. This next payout of $1.550 per share is not just a number but a testament to the stock’s commitment to shareholder value.

Our in-depth analysis delves into how this addition fits into a strategy optimized for Dividend Safety, Returns Risk, Yield Attractiveness, and Returns Potential. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 27, 2023.

Join us as we dissect the mechanisms that make this stock a beacon for those navigating the choppy waters of retirement investments.