Are you a retirement dividend investor looking for a new opportunity to enhance your portfolio? A well-covered mid-cap consumer products stock has recently caught the attention of experts, marking a significant addition to the Best Dividend Protection Stocks model portfolio. This company stands out for its impressive track record of dividend growth, ranking in the top 10% of dividend stocks. With a 13-year history of consistent dividend increases, it’s a beacon of reliability in the turbulent world of investments.

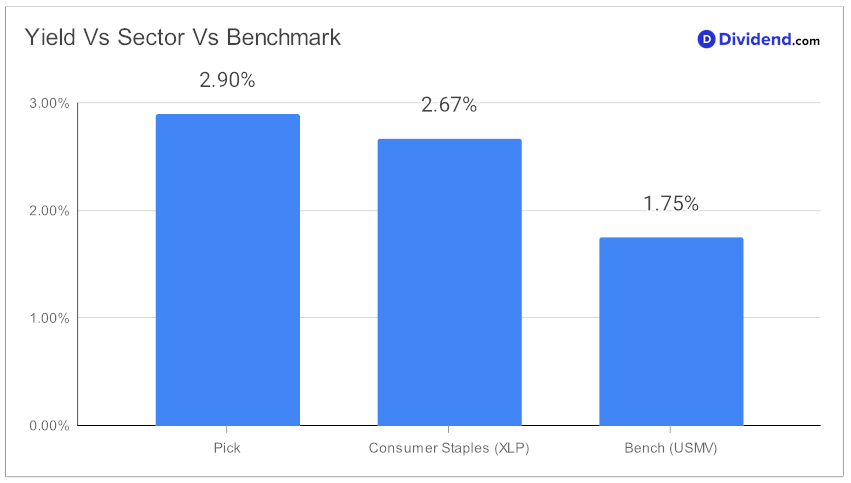

What’s more, the future looks bright with expectations of continued dividend hikes. The company is set to make its next payout soon, offering an unchanged but qualified $0.780 per share, going ex-dividend on December 29. This presents a timely opportunity for investors seeking steady income. The stock currently yields 2.90%, marginally better than that of the sector and this portfolio’s benchmark.

This addition to the portfolio was carefully selected, optimized for both Dividend Safety and Returns Risk. While Yield Attractiveness and Returns Potential were also considered, the emphasis was primarily on the former aspects, ensuring a more secure and stable investment. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 8, 2023.

In the detailed analysis that follows, we delve deeper into the fundamentals and future prospects of this stock. Discover why it’s a top pick for those seeking a blend of safety and growth in their retirement portfolio.