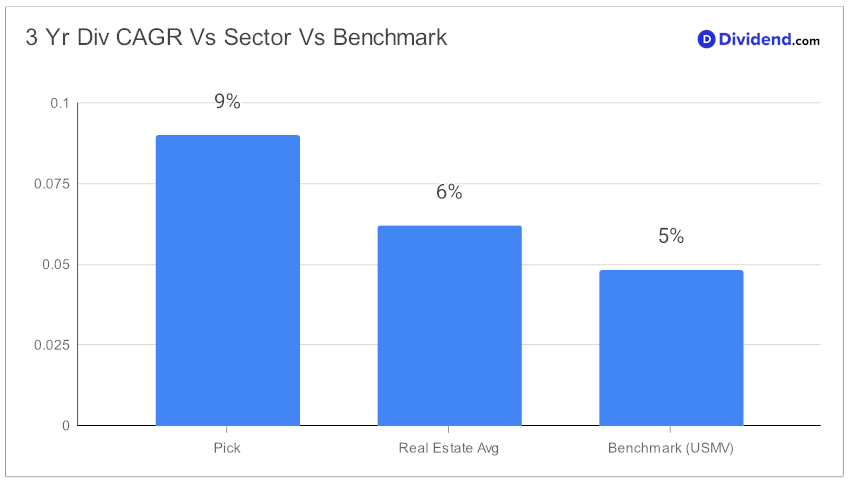

In the ever-evolving quest for financial security, a newly inducted holding in the esteemed Best Dividend Protection Stocks model portfolio stands out, especially for those eyeing retirement. This well-covered large-cap eREIT shines as a beacon of stability and growth, boasting an impressive 12-year streak of dividend increases—a feat that places it among the top 10% of dividend-yielding stocks. With a 9% 3-year dividend per share compound annual growth rate, it ranks well within the top 40%, offering a promising blend of safety and growth potential.

Diversification is key in any investment strategy, and with a beta of 0.68, this stock promises lower correlation with broader equity market fluctuations, ensuring a more stable portfolio. For those seeking tangible returns, the anticipation of an estimated $1.700 per share payout around March 8th adds an immediate allure.

This article will delve deeper into why this addition is not just another stock pick but a strategic move for those prioritizing dividend safety and returns, shedding light on the meticulous recommendation process that prioritizes not just yield attractiveness but also dividend safety and potential returns. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 26, 2023.

This approach ensures that investments are not merely about the immediate gains but about securing a prosperous future.