In the realm of retirement investment, the tranquility of a secure dividend is invaluable. Discerning investors, meet the newest entrant in our Best Dividend Protection Stocks model portfolio—a standout eREIT characterized by a robust 8-year history of dividend amplifications. This sterling record not only places it in the upper echelons—top 30%, to be precise—of dividend stocks but also signals promising prospects for further escalations.

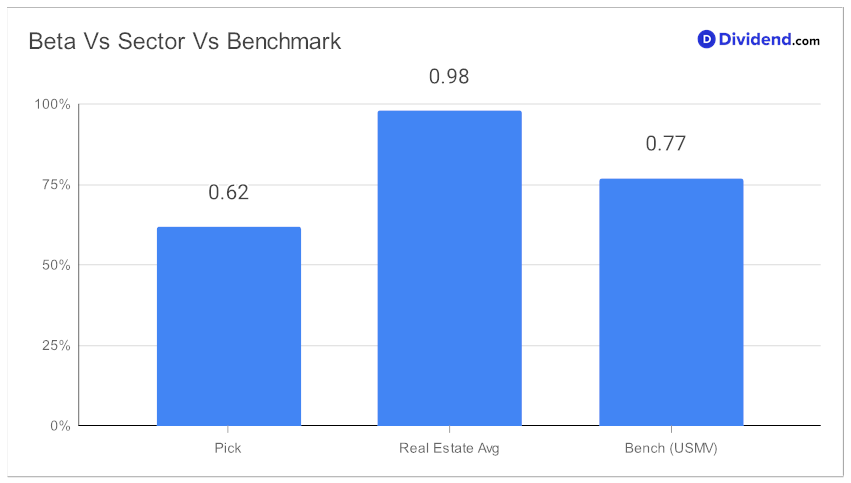

While this year’s return statistics underscore its resilience—registering a 7% uptick amidst an industry downtrend of -9%—its 0.62 beta serves as a testament to its low correlation with broader equity markets. This trait isn’t just rare; it’s a portfolio diversifier, an attribute that can contribute to smoothing overall investment volatility.

As the calendar inches towards November, portfolio eyes are set on the upcoming disbursement—an anticipated $3.410 per share, promising to add that extra layer of financial cushioning.

Having said that, it is important to note that this year, REITs across various sectors have faced significant downturns, primarily due to credit constraints and surging rates.

However, our recent pick, specializing in data centers, emerges resilient amidst this turmoil. The relentless expansion in cloud services, IoT, Big Data, AI, self-driving technology, and immersive platforms underscores a thriving demand for these facilities. The company stands at the forefront, its diverse global data centers poised to capitalize on businesses’ mounting dependence on advanced tech and rapid digital transitions. Furthermore, its financial solidity is bolstered by a recurring revenue model, encompassing colocation, interconnection, and comprehensive IT infrastructure services, ensuring a stable cash flow trajectory.

Curious about the intricate facets that make this stock a prudent pick? Dive into our comprehensive analysis that follows, where we unfold layers of dividend safety, returns risk, yield attractiveness, and returns potential. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 2, 2023.

Investment isn’t just about figures; it’s about securing a future where peace of mind is the real dividend.