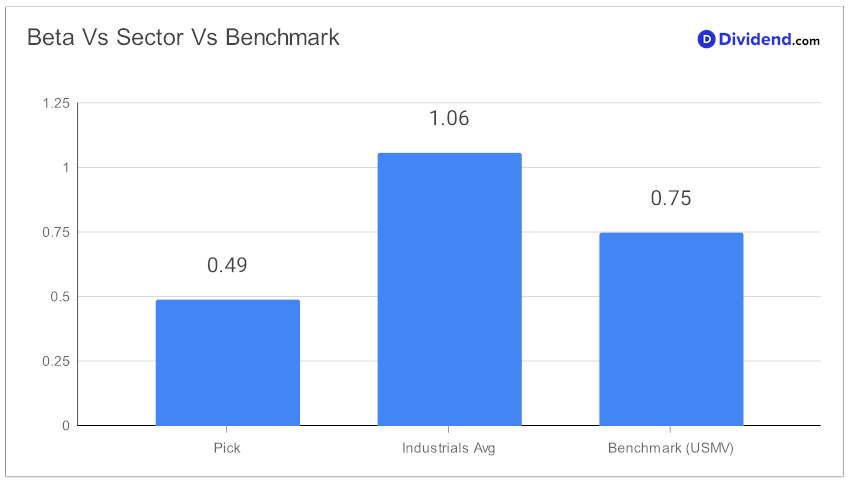

In the world of retirement investing, securing a portfolio that offers both stability and attractive dividends is paramount. One standout large-cap Aerospace & Defense stock has recently been added to the Best Dividend Protection Stocks model portfolio, underscoring its robust dividend safety and promising returns potential. This addition comes on the heels of its impressive 21-year track record of dividend increases, positioning it in the elite top 10% of dividend-yielding stocks. Notably, its low beta of 0.49 indicates minimal correlation with broader equity market fluctuations, offering a unique diversification advantage for investors looking to mitigate portfolio volatility.

Investors will be particularly interested in the stock’s upcoming dividend payout, maintaining a generous $3.150 per share. This unchanged qualified distribution is set to go ex-dividend imminently on February 29, presenting a timely opportunity for those looking to enhance their income streams.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on January 23, 2024. The defense contractor concluded the previous year with a record backlog of more than $150 billion. With projections of low single-digit sales growth in 2024 and expected free cash flow of well over $5 billion, the company signals strong demand across its aerospace and defense product portfolio. And, despite some program delays, the company’s diverse offerings and strategic investments are likely to help it thrive in the currently uncertain economic environment and remain competitive in its industry.

The selection of this stock into the portfolio was meticulously based on optimizing dividend safety and minimizing returns risk, while also considering yield attractiveness and potential returns. The in-depth analysis that follows will delve deeper into the strategic rationale behind this choice, offering retirement dividend investors a comprehensive understanding of its potential impact on their investment objectives.