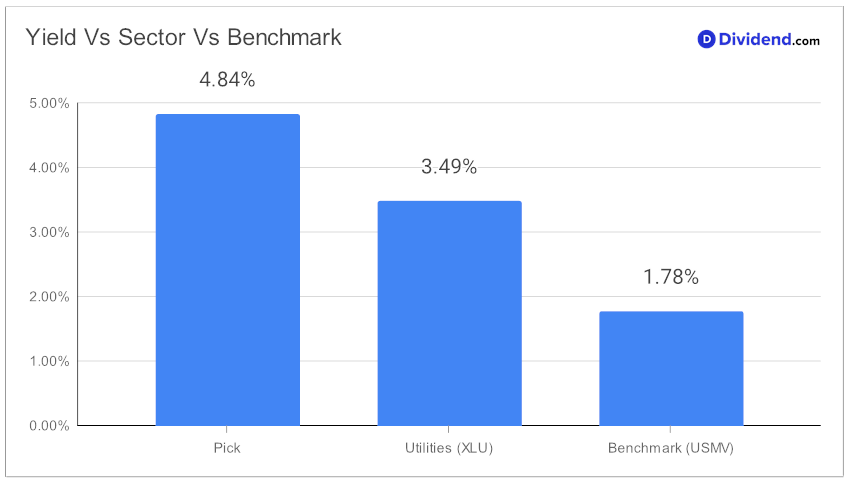

In the quest for stability and growth, retirement dividend investors constantly seek assets that not only provide attractive yields but also boast a reliable history of growth. One such stock, recently added to a prestigious model portfolio for Best Dividend Protection Stocks, stands out for its robust dividend credentials. With a forward dividend yield that surpasses the industry average, this large-cap Integrated Utilities stock offers a compelling 4.84% yield, positioning it in the upper echelons of dividend-paying stocks.

Remarkably, its 21-year track record of dividend increases signals not just past reliability but also a promising outlook for future growth.

As the next payout date approaches, with an estimated dividend of $0.780 per share on the horizon, investors are reminded of the stock’s commitment to rewarding its shareholders.

This inclusion is the result of a meticulous recommendation process focusing on Dividend Safety, Returns Risk, Yield Attractiveness, and Returns Potential, ensuring that investors are presented with options that align with their goals for income and security in retirement. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 2, 2023.

The following analysis delves deeper into the stock’s performance, providing a thorough examination of its dividend sustainability and growth prospects, guiding investors towards making informed decisions in their retirement planning journey.