In the quest for a resilient income stream, retirement investors are often on the lookout for stocks that offer a blend of stability, consistent growth, and a shield against market volatility. Among the latest entrants to the esteemed Best Dividend Protection Stocks model portfolio is a standout large-cap Aerospace & Defense player, whose robust fundamentals are as solid as the industry it leads. With a modest 36% forward payout ratio, this stalwart echoes the sector’s average and exemplifies sustainable shareholder remuneration.

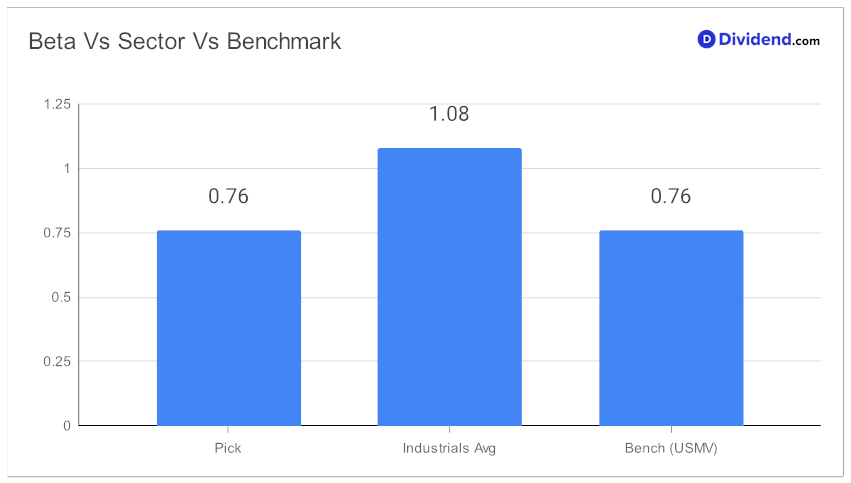

Investors will note the remarkable 30+ year legacy of dividend increases, a testament to the company’s enduring financial strength and commitment to returning value. This ranks it within the elite decile of dividend stocks, with an anticipation of continued growth. Moreover, its 0.76 beta signifies lower correlation to market swings, promising a smoother ride amidst turbulent economic seas.

For those marking their calendars, the next payout remains steady at $1.320 per share, having gone ex-dividend on October 5, with the payout date on November 10.

The full in-depth analysis to follow delves deeper into this company’s dividend robustness, dissecting its potential to secure and grow investor returns while striking a fine balance with yield attractiveness. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 26, 2023.

Stay tuned to uncover why this could be the bastion your portfolio needs to weather the stormy markets of tomorrow.