Are you a retirement investor looking for a reliable dividend stock to bolster your portfolio? Look no further. Our latest addition to the Best Dividend Protection Stocks model portfolio is a well-covered large-cap stock in the Aerospace & Defense sector. This pick stands out for its impressive dividend characteristics and stability.

Firstly, with a forward payout ratio of 31%, closely aligning with the industry average, this stock offers a sustainable and well-covered dividend. This is critical for long-term income investors seeking stability. What’s more, it boasts a remarkable 20-year track record of dividend increases, placing it in the top 10% of dividend stocks. This history not only reflects financial robustness but also signals potential future increases, a key factor for those eyeing income growth.

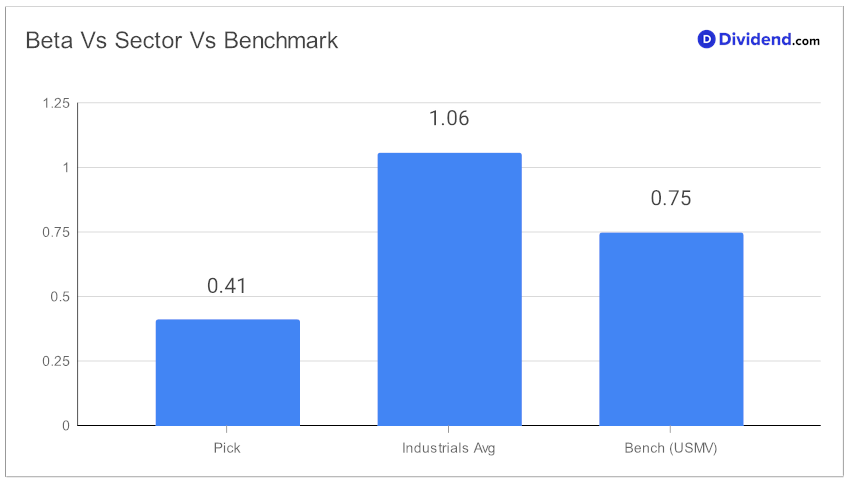

Interestingly, its low beta of 0.41 indicates that the stock’s monthly returns are not heavily correlated with the broader equity markets. This attribute provides a diversification advantage, reducing portfolio volatility – an appealing factor for retirement-focused investors.

The next payout is particularly noteworthy: an unchanged but qualified $1.870 per share, which went ex-dividend on November 24, with a payment date set for December 13. This upcoming payout highlights the stock’s commitment to returning value to its shareholders.

This addition to our portfolio is not just a mere recommendation; it’s backed by thorough analysis and a rigorous process, optimizing for Dividend Safety and Returns Risk, while also considering Yield Attractiveness and Returns Potential. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 26, 2023.

Stay tuned for our in-depth stock analysis, where we delve deeper into the numbers and strategic rationale behind this compelling choice for retirement dividend investors.