If you’re a retirement investor focused on safeguarding your income, you’ll want to pay close attention to the latest addition in our Best Dividend Protection Stocks model portfolio. We’ve recently integrated a well-covered large-cap Consumer Products stock, which stands out for its stellar attributes.

With a forward payout ratio of 48%, this stock is in sync with the Consumer Products sector’s average of 50%. A low payout ratio not only suggests strong coverage but also allows room for future dividend growth. Speaking of growth, it has an impressive 14-year dividend increase track record, placing it among the top 10% of dividend stocks. Further growth in dividends is anticipated, adding to its allure.

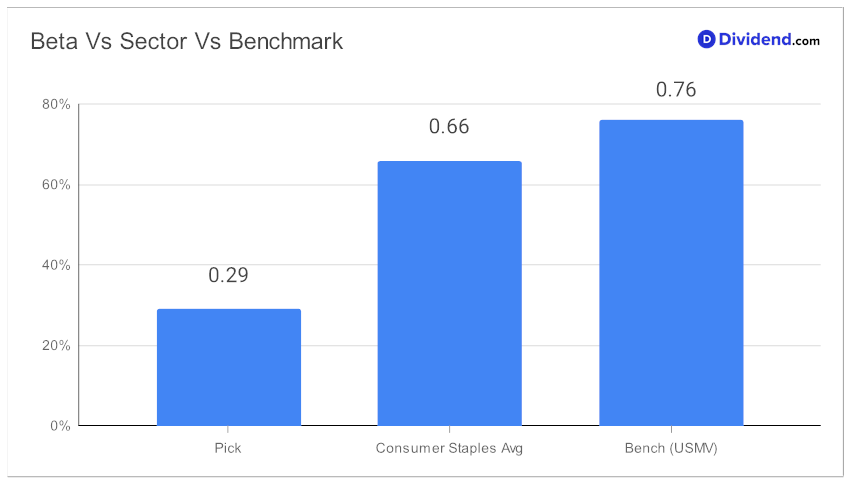

The stock also boasts a three-year dividend per share Compound Annual Growth Rate (CAGR) of 12%, which places it in the top 40% of all dividend stocks. But it’s not just about the returns; it’s also about risk mitigation. With a beta of 0.29, this stock’s monthly returns show little correlation with the equity markets, offering a diversification benefit for your portfolio.

It is important to note that the company has been facing inflationary pressure for a while both in terms of higher selling & marketing expenses and raw material costs, especially for cocoa and sugar. This is reflected in its YTD performance, wherein the stock is down nearly 8% compared to S&P 500’s 18% gain.

However, the company is likely to leverage its pricing power and brand strength to overcome these issues in the coming days.

The next payout is expected to come in at around $1.192 per share, with an estimated date of November 3.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on July 26, 2023.

Keep reading for an in-depth stock analysis, designed to help you optimize for Dividend Safety and Returns Risk, and to a lesser extent, Yield Attractiveness and Returns Potential.