Dive into the realm of dividend investing where one of the latest additions to our Best Dividend Protection Stocks model portfolio takes center stage. This well-covered mega-cap Biotech/Pharma gem shines with a forward payout ratio of 40%, perfectly aligning with the industry average. It’s not just about the numbers, it’s about consistency too! With a proud 12-year record of dividend increases, it ranks in the top 10% of dividend stocks, and the horizon gleams with anticipated future increases.

Boasting a low beta of 0.36, this powerhouse promises a lack of correlation to equity market trends, offering an attractive diversification strategy. It’s been a steady ship amidst turbulent markets, delivering a return of 3% YTD.

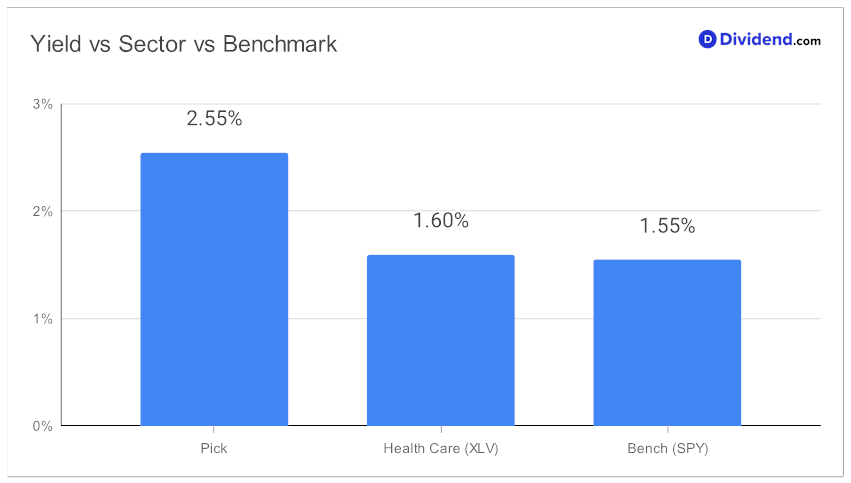

Brace for an upcoming payout – an unchanged qualified $0.730 per share, which went ex-div on Jun 14 with a pay date of Jul 10. Additionally, with a forward yield of 2.55%, our pick beats its sector and the benchmark for this portfolio.

Stay tuned for the comprehensive review that follows, where we intricately dissect this stellar pick, optimizing for Dividend Safety and Returns Risk while considering Yield Attractiveness and Returns Potential. Enjoy the journey of dividend investing, where consistent payouts meet security and growth.