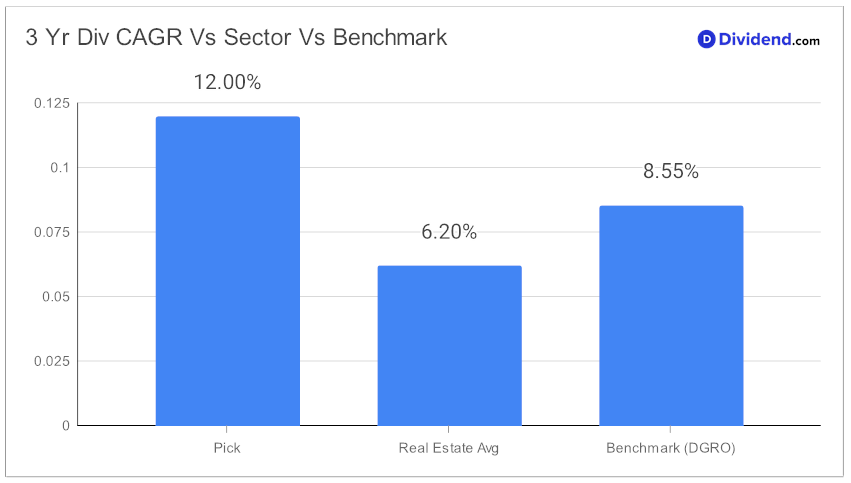

In the landscape of dividend growth investing, discerning investors continually seek robust opportunities that promise not only stability but also a commendable growth trajectory. Amidst this search, a certain mid-cap eREIT stands out, not just for its commendable 12-year track record of dividend increases—a feat placing it in the elite top 10% of dividend stocks—but also for its anticipated future growth. With a three-year dividend compound annual growth rate (CAGR) of 12%, positioning it firmly within the top 40% of all dividend stocks, it presents a compelling case for those optimizing for returns potential.

As dividend growth investors scrutinize the market for investments that offer not only safety and yield attractiveness but also minimized returns risk, the upcoming payout, estimated at $1.270 per share on or around March 1st, becomes a significant point of interest. This detail not only underscores the eREIT’s commitment to shareholder returns but also highlights the predictive confidence in its financial health and operational stability.

This brief insight serves as a precursor to an in-depth analysis that will further unravel the intricacies of this investment, offering a comprehensive look into its returns potential, dividend safety, and overall attractiveness within the dividend growth investing sphere. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 9, 2024.