In the constellation of income-generating stars, a certain large-cap eREIT shines brightly, distinguishing itself as a new addition to the coveted Best Dividend Growth Stocks model portfolio. This standout performer has not only maintained an 8-year streak of dividend enhancements but also boasts a spot in the top tier of dividend stocks—a beacon for those seeking reliability and growth in their investments.

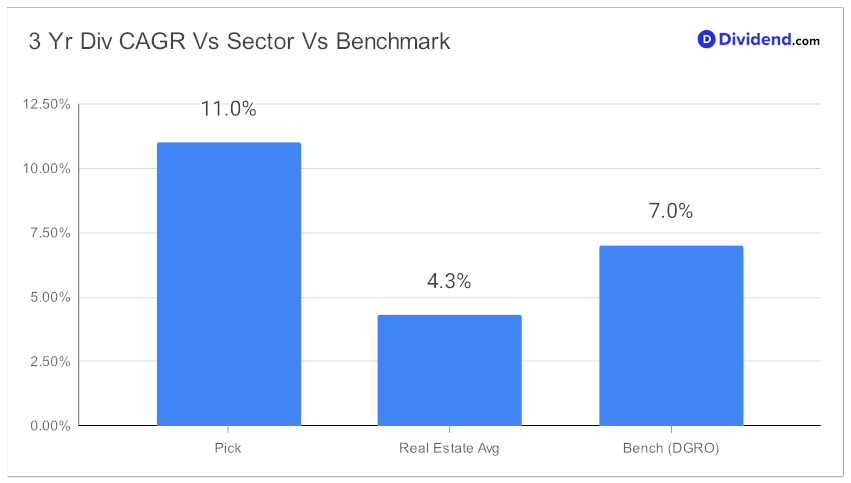

With a 3-year dividend compound annual growth rate (CAGR) of 11%, it stands proudly in the upper echelons, signaling robust financial health and a commitment to shareholder returns. Adding to its allure is a beta of 0.62, painting a picture of an asset unswayed by the broader equity market’s tempests—promising smoother sailing for investors aiming for diversification.

The year-to-date figures tell a tale of resilience and prosperity, outshining both the S&P 500 and its industry peers. And now, investors are poised on the cusp of a momentous occasion: a generous next payout that features a 24.9% hike to a qualified $4.260 per share, going ex-dividend on the near horizon.

Having said that, it is important to note that this year, REITs across various industries have faced significant downturns, primarily due to credit constraints amidst surging interest rates.

However, our recent pick, specializing in data centers, emerges resilient amidst this turmoil. The relentless expansion in cloud services, IoT, Big Data, AI, self-driving technology, and immersive platforms underscores a thriving demand for these facilities. Overall, the REIT’s global presence coupled with its focused approach to specifically target retail and enterprise-level AI application needs continues to ensure steady cash flows.

This teaser merely grazes the surface of an in-depth analysis that awaits. For the discerning investor, the full exploration offers a pathway to unlocking the potential of a stock that is not just a holding but a statement of strategic foresight. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 2, 2023.