In the realm of dividend growth investing, a noteworthy opportunity has emerged within the large-cap Machinery stock sector. A prominent company, renowned for its solid dividend growth profile, has been recently incorporated into the Best Dividend Growth Stocks model portfolio. This inclusion is particularly appealing for investors seeking consistent and sustainable income growth.

The company in question stands out with a forward payout ratio of 25%, closely mirroring the Machinery industry’s average. This not only reflects a sustainable approach to dividend distribution but also suggests room for potential growth. A remarkable aspect of this stock is its 60+ year streak of dividend increases, placing it among the top echelon of dividend stocks. This long-standing record of growth is indicative of the company’s steadfast commitment to shareholder returns.

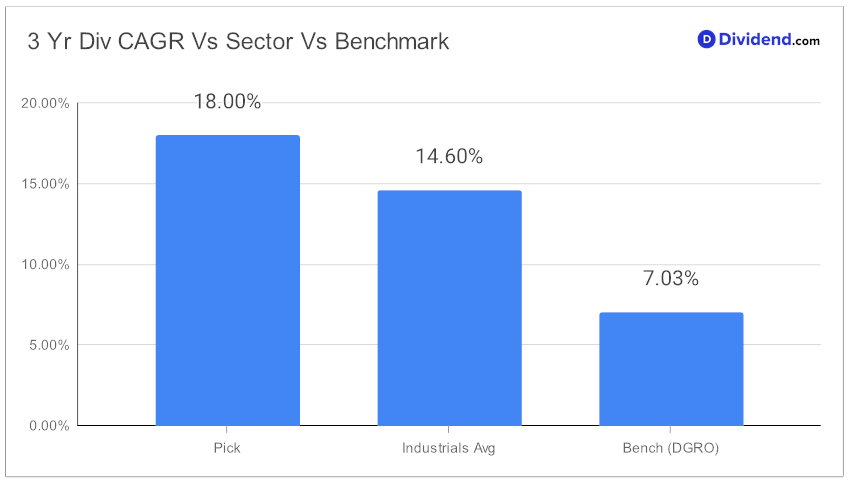

Further emphasizing its appeal, the stock exhibits a robust 18% three-year dividend per share compound annual growth rate, ranking it impressively in the upper tier of dividend stocks.

Its performance is also notable in the broader market context, with a year-to-date return of 53%, substantially outperforming the S&P 500 and its industry peers.

The immediate attraction for dividend investors is the upcoming payout, estimated at $1.480 per share, slated for around January 26. This forthcoming dividend is a significant draw for those focused on short-term income.

The stock’s addition to the portfolio is the result of a rigorous selection process that prioritizes Return Potential through dividend growth, along with Dividend Safety. Other factors like Returns Risk and Yield Attractiveness play a lesser, yet still relevant role in this decision-making process. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q1 2024 earnings call held on November 3, 2023.

For investors keen on a deeper understanding, an extensive analysis awaits, delving into the company’s financial stability, market standing, and prospects for future growth.