Investors seeking sustainable and growing returns might find their next portfolio addition in a top-performing Energy MLP, now featured in the Best Dividend Growth Stocks model portfolio. With a substantial forward dividend yield of 9.27%, surpassing the industry average of 6.9%, this large-cap stock stands out for its high yield – a critical factor in selecting robust dividend stocks. However, it’s essential to navigate such high yields carefully to avoid potential dividend traps.

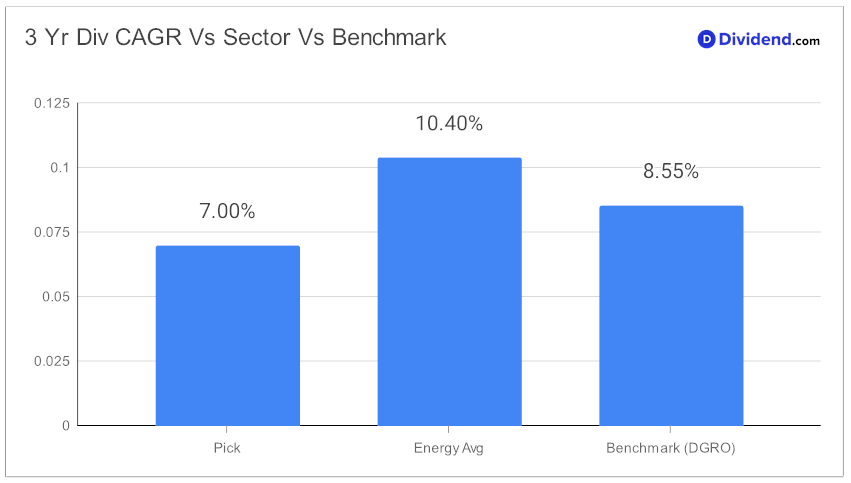

This stock doesn’t just offer a tempting yield; it boasts a commendable 10-year track record of dividend increases, placing it favorably among the top 30% of dividend stocks. This consistency signals a promising outlook for future dividend growth. Moreover, with a 7% 3-year dividend compound annual growth rate (CAGR), it ranks impressively in the top 40%, showcasing a robust growth trajectory.

Investors should note the next anticipated payout of an estimated $0.850 per share, expected around January 25th.

This inclusion reflects a strategic focus on optimizing returns potential through dividend growth, without compromising on dividend safety, returns risk, or yield attractiveness. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 31, 2023.

For a more in-depth analysis, the following article dissects the stock’s performance, dividend reliability, and growth prospects, providing a comprehensive understanding for dividend growth investors keen on expanding and enriching their portfolios.