Are you a dividend growth investor seeking a robust addition to your portfolio? Look no further than this exceptional large-cap eREIT, a shining example in our Best Dividend Growth Stocks model portfolio. This company stands out for its remarkable track record in dividend growth, placing it firmly in the top tier of dividend stocks.

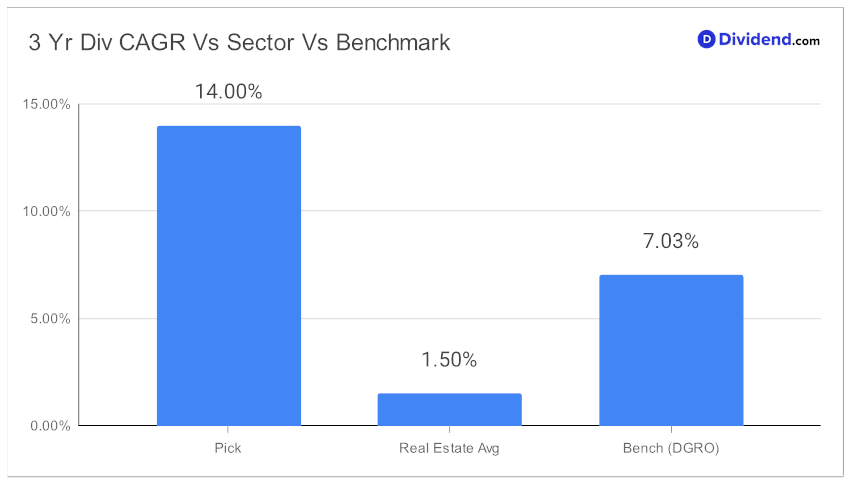

One key highlight is the impressive 10-year streak of dividend increases, a performance that not only ranks in the top 30% of dividend stocks but also signals a strong likelihood of future hikes. Adding to this allure is the company’s 3-year Dividend per Share Compound Annual Growth Rate (CAGR) of 14%, a figure that surpasses 40% of all dividend stocks.

As one of the world’s largest logistics landlords, the company continues to see industrial property demand holding up. This is despite a shift in the U.S. from consumers focused on spending on goods to services – a trend that has led to weaker demand for warehousing solutions following years of growth during COVID-19.

Looking ahead, dividend growth investors can eagerly anticipate the next payout, estimated at $0.870 per share, slated for on or around December 7th. This upcoming distribution is a testament to the company’s commitment to rewarding shareholders and underlines its potential as a lucrative investment.

Our recommendation process prioritizes Return Potential through dividend growth, complemented by Dividend Safety, and to a lesser extent, Returns Risk and Yield Attractiveness. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 18, 2023. This approach ensures that we spotlight only the most promising stocks for our investors.

Stay tuned for an in-depth stock analysis, where we delve deeper into why this eREIT is a must-have in your dividend growth portfolio. Discover how it not only promises consistent returns but also offers a glimpse into the future of savvy investing.