Step into the world of sound investment with a dynamic addition to the Best Dividend Growth Stocks model portfolio – a standout player in the realm of Integrated Utilities.

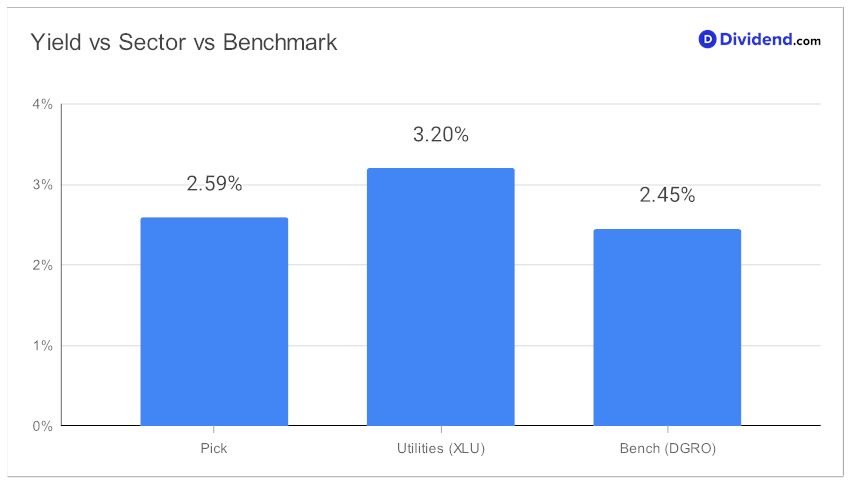

With an unyielding 30-year track record of dividend increases, this powerhouse ranks in the top 10% of dividend stocks, an accolade signaling promising future increases. Their impressive 10% 3-year dividend per share CAGR securely situates them within the top 40% of all dividend stocks, further reinforcing their stellar performance. Additionally, the stock yields 2.59% – just below the sector average but above the portfolio benchmark.

What’s more, with a low beta of 0.46, this stock promises diversification, proving its worth as an attractive and safe investment.

Set your calendars for July 28 as they’re projected to payout an attractive $0.468/share.

Our robust recommendation process optimizes for Return Potential via dividend growth and Dividend Safety, while also considering Returns Risk and Yield Attractiveness.

Intrigued?

Discover the full potential of this stock in our in-depth analysis to follow.