Investors focused on dividend growth, take note! A standout in the Consumer Products sector has continued to impress with its consistent performance and robust dividend track record.

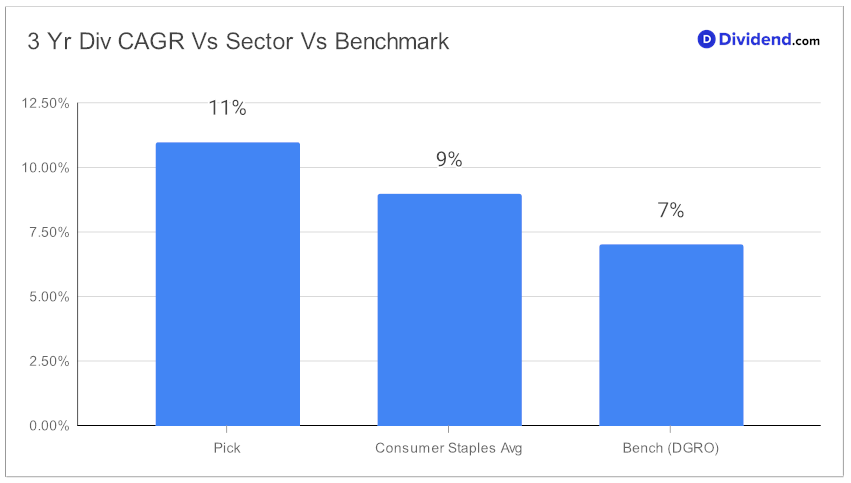

This large-cap stock has demonstrated a remarkable 12-year streak of dividend increases, placing it in the top 10% of dividend stocks. What’s more, its 3-year dividend compound annual growth rate (CAGR) of 11% ranks it in the upper echelon of dividend-paying stocks.

Even in volatile markets, this stock has shown resilience with a beta of 0.67, indicating less correlation with broader market swings—a key factor for diversifying an equity portfolio. While the S&P 500 has soared by 21%, this stock has maintained a steady 9% return year-to-date, outperforming the Consumer Products industry, which has seen a decline of 3%.

Dividend growth investors can look forward to the next payout, estimated at $0.425 per share, expected around December 8th. This payout is a testament to the stock’s commitment to rewarding shareholders consistently.

Our in-depth analysis delves deeper into why this stock remains a key holding in the Best Dividend Growth Stocks model portfolio. We optimize for Return Potential through dividend growth and Dividend Safety, while also considering Returns Risk and Yield Attractiveness. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 6, 2023.

The upcoming analysis will provide a comprehensive view of the stock’s performance, strategic positioning, and future prospects, making it a must-read for savvy investors seeking sustainable dividend growth.