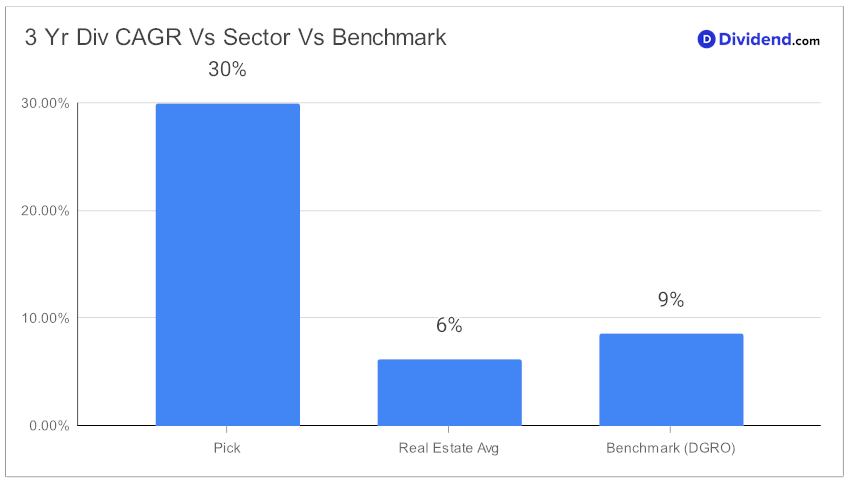

In the dynamic landscape of dividend growth investing, a standout large-cap eREIT continues to demonstrate robust performance, as evidenced by its impressive three-year dividend compound annual growth rate (CAGR) of 30%. This remarkable growth not only places it in the top 20% of all dividend stocks but also signals a promising future for investors focused on dividend growth.

What’s particularly intriguing about this eREIT is its low beta of 0.73, hinting at a unique characteristic: its monthly returns show minimal correlation with broader equity markets. This trait offers a strategic diversification option for investors looking to balance their equity portfolios.

Investors with an eye on upcoming gains should note the next payout, estimated at $0.220 per share, scheduled for on or around February 9. This upcoming distribution is not just a short-term benefit but a part of a larger, well-thought-out investment strategy. The recommendation process prioritizes Returns Potential via consistent dividend growth, underpinned by Dividend Safety. While Returns Risk and Yield Attractiveness are also considered, they play a secondary role in the overall strategy. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 5, 2023.

This enticing overview serves as a gateway to a more in-depth analysis that follows. It delves into the nuanced aspects of this eREIT’s performance, providing a comprehensive understanding of its potential as a key component in a dividend growth investor’s portfolio.