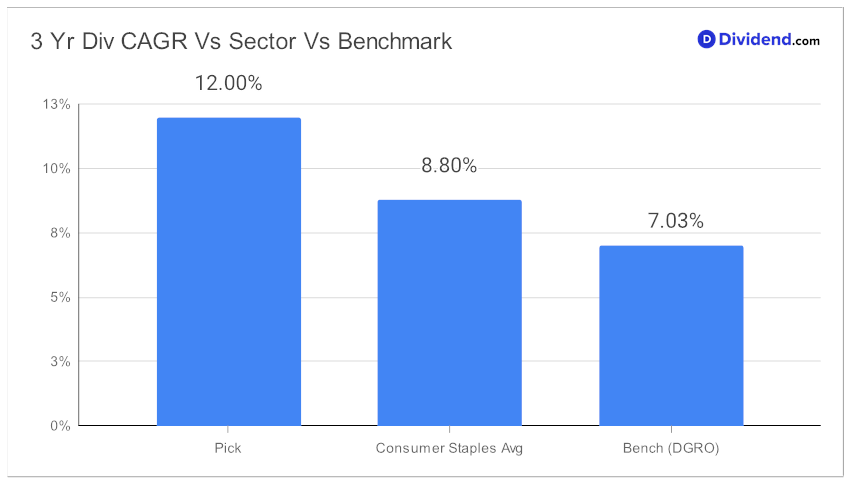

Looking to add a powerhouse performer to your dividend growth portfolio? Consider this well-covered large-cap Consumer Products stock. With a 14-year dividend increase track record, this investment opportunity ranks in the top 10% of all dividend stocks. Future increases are anticipated, only sweetening the deal for long-term investors. When it comes to 3-year dividend per share compound annual growth rate (CAGR), it impresses yet again, ranking in the top 40% of dividend payers with a stellar 12% CAGR.

Worried about market volatility? This stock boasts a low 0.34 beta, suggesting that its monthly returns are not heavily correlated with broader equity markets. It serves as an excellent tool to diversify an equity portfolio, mitigating the risks associated with market swings.

What’s more, keep your eyes peeled for the next payout, estimated to be a generous $1.192 per share, to be dispersed on or around November 3. This information comes as part of our rigorous recommendation process, which focuses primarily on Returns Potential via dividend growth and Dividend Safety. We also consider, to a lesser extent, Returns Risk and Yield Attractiveness.

Additionally, we have taken into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on July 27, 2023.

Eager to learn more? The following in-depth stock analysis will provide further insights into why this could be the next game-changing addition to your portfolio.