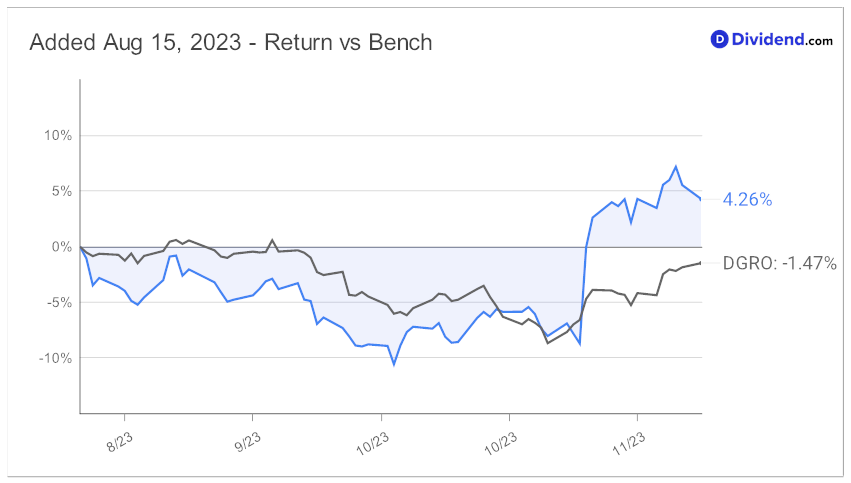

In the dynamic world of dividend growth investing, finding a stock that combines consistency with potential can be a challenging endeavor. However, investors seeking a blend of steady dividend growth and promising returns should take note of a particular large-cap Gaming/Lodging/Resto stock, a stalwart in the Best Dividend Growth Stocks model portfolio. This stock stands out with its 14-year track record of dividend increases, placing it in the top 10% of its category. Additionally, since making it to this portfolio back in August 2023, the stock has comfortably outperformed the portfolio benchmark.

Year-to-date, the stock has presented a 7% return, trailing behind the industry average of 13% and the S&P 500’s 19%. Despite this, its future prospects remain bright, with expected further increases in dividends. The next payout is particularly noteworthy—a 7.5% increase to a qualified $0.570 per share, which went ex-dividend on November 9 and is scheduled for payment on November 24.

This stock is a prime example of how a balanced approach to dividend growth, safety, and yield attractiveness can create an optimal investment opportunity. The upcoming in-depth analysis will delve deeper into the financials and market positioning of this stock, offering insights into why it remains a top pick for dividend growth investors. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on November 3, 2023.

Stay tuned for a comprehensive evaluation of its potential returns and risks, cementing its status as a key holding in any dividend-focused portfolio.