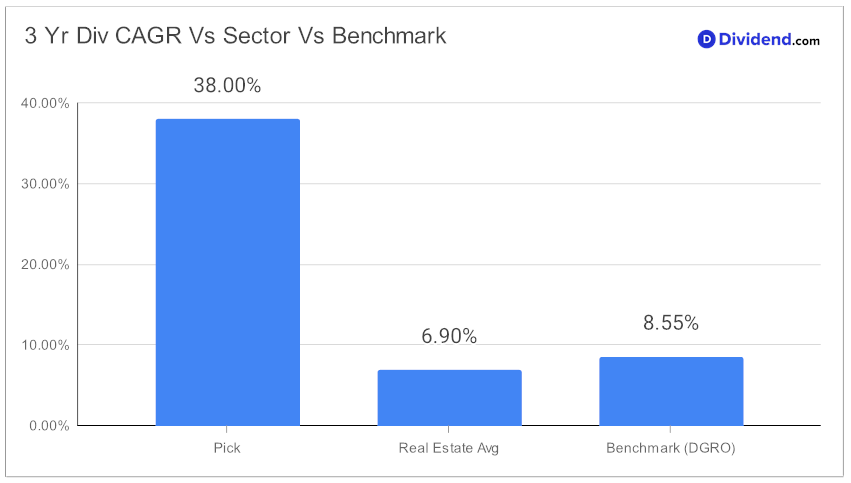

In the realm of dividend growth investing, the allure of stability coupled with potential high returns is irresistible. One significant player in the eREIT sector is distinguishing itself by its exceptional dividend growth and robust financial health. With a 3-year dividend compound annual growth rate (CAGR) that stands in the top 20% of all dividend stocks, this company exemplifies both growth and resilience.

Its beta of 0.70 indicates its monthly returns are less correlated with the broader equity markets, offering an attractive diversification option for investors looking to stabilize their portfolios.

Investors have more to look forward to, as the next anticipated dividend payout is estimated at $0.260 per share, scheduled on or around May 9. This payout underlines the firm’s commitment to returning value to shareholders and its capacity to maintain a steady dividend stream.

This real estate company recorded an 8% increase in core financial metrics in 2023, thriving amidst a leadership change and a challenging economic environment. Key to its success is the strategic expansion of its housing supply, tailored to meet persistent demand due to national housing shortages.

The outgoing CEO highlighted the focus on quality, internally developed homes, while the incoming CEO projected steady growth for 2024, despite potential hurdles like rising property taxes and inflation. The financial strategy remains robust, underscored by successful capital market maneuvers including green bond issuances, underscoring a commitment to sustainable growth and shareholder value.

For those keen on understanding the nuances behind such dividend growth and stability, an in-depth stock analysis reveals the company’s strategic approach. By prioritizing returns potential through dividend growth, closely monitoring dividend safety, and evaluating returns risk and yield attractiveness, the company ensures it remains a top contender for dividend growth investors. This analysis not only reaffirms the strength of its financial position but also underscores its potential for future growth and stability in a volatile market environment.