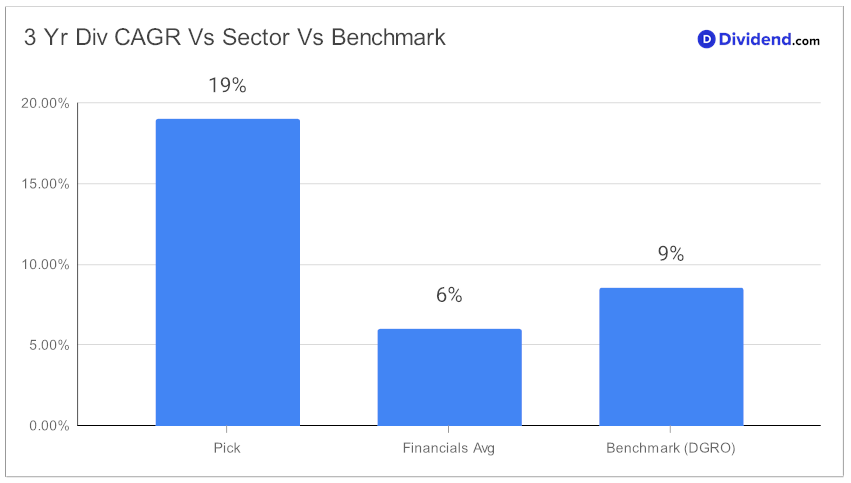

In the dynamic landscape of dividend growth investing, a large-cap banking stock has recently garnered attention for its compelling financial performance. Standing out with a 27% forward payout ratio, this entity aligns closely with the banking sector’s average of 35%, signaling a balanced approach to shareholder returns and financial stability. Its exceptional 3-year dividend compound annual growth rate (CAGR) of 19% places it in the top echelon of dividend stocks, underscoring its potential for long-term growth.

This fiscal prudence has translated into tangible returns. Year-to-date, the stock has outperformed, yielding a 4% return compared to the S&P 500’s 2% and the banking industry’s 1%.

The upcoming dividend payout further underscores its appeal. Investors can look forward to a 14.6% increase in the qualified dividend to $0.550 per share, going ex-dividend tomorow, February 1st. This increase not only reflects the company’s robust financial health but also its commitment to shareholder value.

The recommendation process for this stock emphasizes optimizing returns potential through dividend growth, followed by dividend safety. While returns risk and yield attractiveness are also considered, the primary focus remains on sustainable growth and secure payouts. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on January 25, 2024.

For those seeking a deeper dive into the stock’s prospects, an in-depth analysis follows, providing a comprehensive evaluation of its performance metrics, growth potential, and position within the broader market context.