In a move signaling robust confidence in consistent financial performance, a notable addition has been made to the Best Dividend Growth Stocks model portfolio—a distinguished mega-cap entity from the Gaming, Lodging, and Restaurant industry. This addition is notable for its impressive 40+ year history of dividend growth, positioning it within the elite top 10% of dividend stocks. With a Compound Annual Growth Rate (CAGR) of 8% over three years for dividends per share, it stands strong in the top 40%, underscoring its solid track record and promising outlook for dividend growth investors.

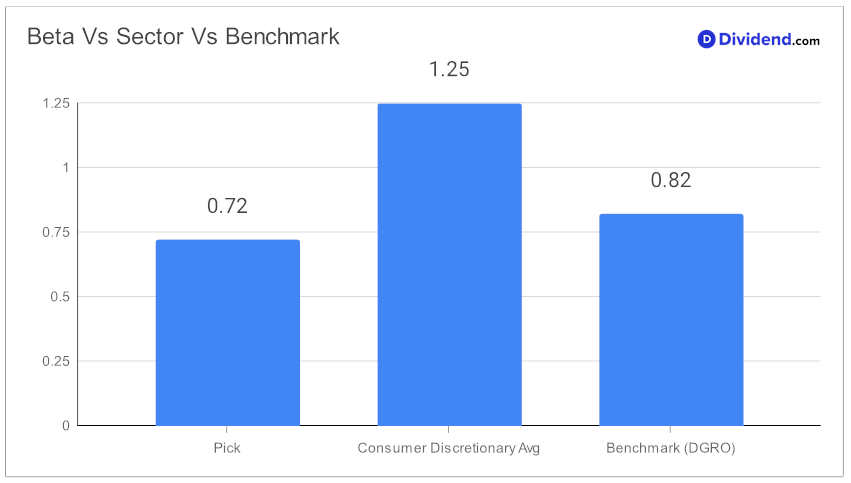

Moreover, its relatively low beta of 0.72 suggests a lower correlation with equity market fluctuations, offering an attractive diversification benefit to investors’ portfolios. Anticipation grows as the next estimated payout of $1.670 per share is on the horizon, expected on or around May 24.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 06 Feb, 2024. The global fast-food chain reported resilient growth amidst economic challenges, with a notable increase in global comparable sales and customer counts. The company’s strategic focus on customer experience, operational efficiency, and digital engagement has underpinned its success. Despite geopolitical tensions affecting some segments, the company highlighted innovation in product offerings and expansion of its loyalty program as key drivers.

Looking ahead, the management plans to navigate economic uncertainties with a focus on menu innovation, digital engagement, and global expansion, aiming for significant restaurant openings by 2027. The financial performance reflects an adjusted earnings per share (EPS) increase, emphasizing strategic investments and efficient capital management to support long-term growth.

This strategic addition to the portfolio has been carefully selected based on its potential for return, dividend safety, and to a lesser extent, return risk and yield attractiveness. Dive deeper into our comprehensive analysis to uncover the strategic insights and rigorous recommendation process that underscore the potential of this robust dividend growth investment, setting a precedent for both stability and growth in a fluctuating market environment.