In a strategic move that speaks volumes to dividend growth investors, a leading eREIT has recently been added to the esteemed Best Dividend Growth Stocks model portfolio. This addition marks a significant endorsement, given the portfolio’s rigorous selection criteria prioritizing Returns Potential via dividend growth, Dividend Safety, Returns Risk, and Yield Attractiveness.

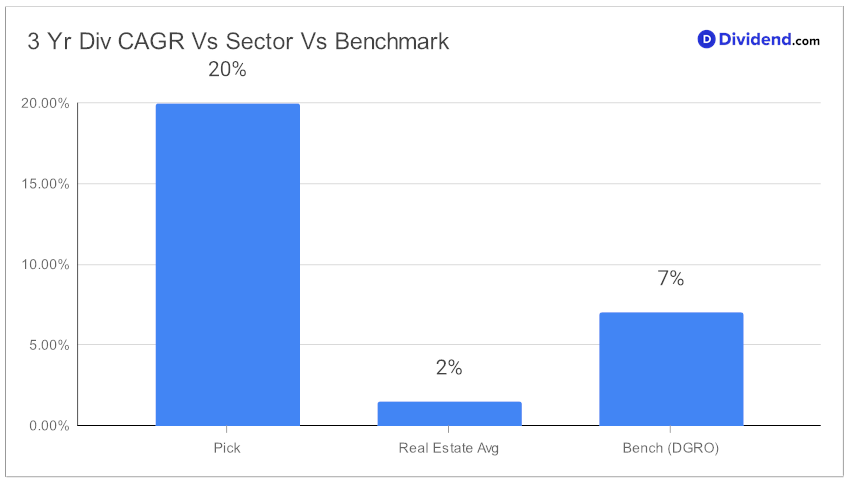

This eREIT stands out with its robust six-year track record of dividend increases, placing it in the top 30% of dividend stocks, signaling a strong likelihood of future growth. Its impressive 20% 3-year dividend/share compound annual growth rate (CAGR) further elevates it into the top echelon, ranking in the top 20% of all dividend stocks.

The stock’s performance has been noteworthy, with a year-to-date return of 16%, surpassing the eREIT industry’s 4% yet trailing behind the S&P 500’s 20%. This juxtaposition offers a nuanced perspective for investors seeking balanced growth and stability.

Investors should particularly note the next payout, estimated at $0.260 per share, slated for on or around February 2. This imminent payout is not just a testament to the eREIT’s dividend reliability but also a tangible benefit for shareholders.

The full in-depth analysis that follows delves deeper into the numbers and the strategic positioning of this eREIT. It offers a comprehensive view, enabling investors to make informed decisions based on a blend of past performance, future potential, and dividend reliability. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 27, 2023.

This inclusion in the Best Dividend Growth Stocks model portfolio is not just a nod to past achievements but a forward-looking indicator of its potential in the dynamic world of dividend growth investing.