A new addition to our Best Dividend Growth Stocks model portfolio offers compelling opportunities for investors focused on steady income and growth. This stock in the Health Care Facilities Services sector not only boasts a low forward payout ratio of 29%, which aligns well with the sector’s average of 22%, but it also has an impressive 14-year track record of increasing its dividend. This places it in the top 10% of all dividend stocks, and future increases are expected.

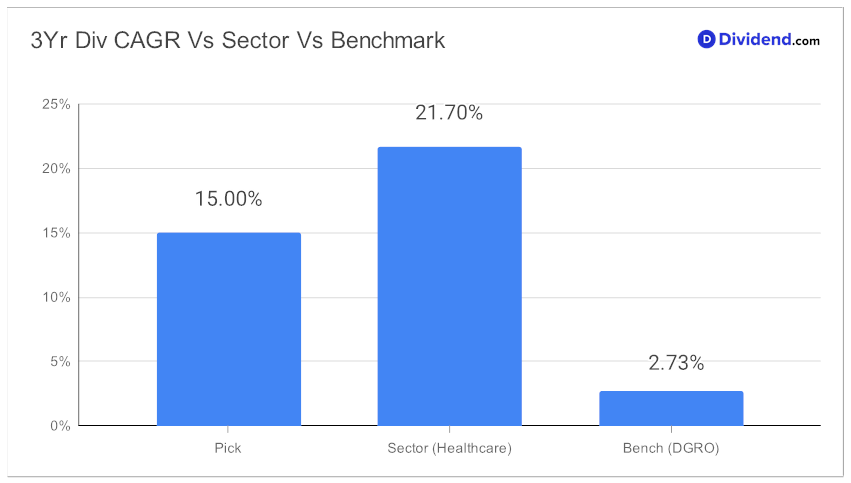

Speaking of growth, the three-year Dividend Compound Annual Growth Rate (CAGR) stands at a robust 15%, positioning it in the top 40% of dividend stocks. For investors concerned about market volatility, the stock’s low beta of 0.67 indicates limited correlation with equity markets, making it an excellent choice for diversifying an equity portfolio.

As for the immediate future, investors can look forward to an unchanged, yet qualified, next dividend payout of $1.880 per share. This payout went ex-dividend on September 8 and is scheduled for distribution on September 19.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on July 14, 2023.

For those eager to delve deeper, the recommendation process for this portfolio addition prioritizes Returns Potential primarily through dividend growth, followed by Dividend Safety.

To a lesser extent, Returns Risk and Yield Attractiveness were also considered. Stay tuned for an in-depth stock analysis that elaborates on these elements.