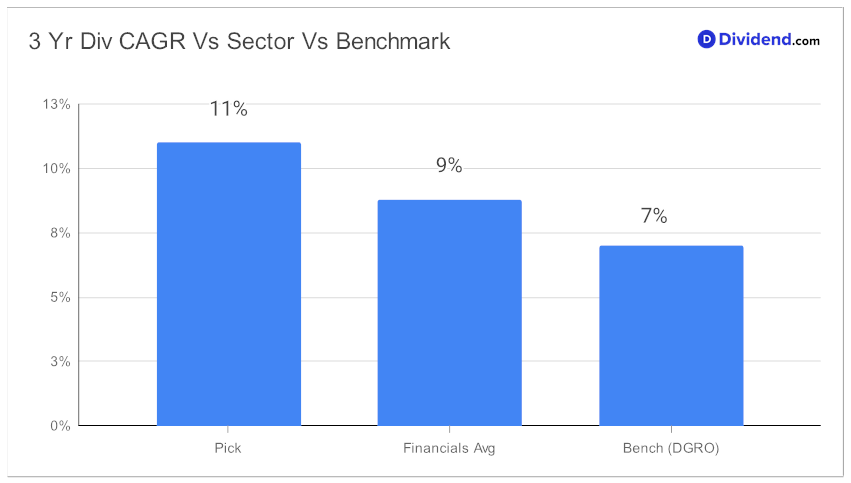

In the realm of dividend growth investing, few opportunities stir as much excitement as a certain superstar within the large-cap Asset Management sector, renowned for its robust dividend increase track record that comfortably sits in the elite top 10% of all dividend-paying stocks. For 14 consecutive years, this juggernaut has not just maintained, but consistently boosted its dividends, showcasing an impressive 3-year dividend compound annual growth rate (CAGR) of 11%—a figure that outshines a significant majority, ranking in the upper 40% tier of dividend stocks.

As dividend growth investors are well aware, the strategy isn’t merely about the current yield but the story of persistent growth and stability that supports future payouts. Speaking of which, shareholders are eagerly anticipating the next payout milestone—an estimated $5.00 per share, expected to arrive in their accounts around November 10th. This payout underscores the company’s commitment to shareholder returns, solidifying its position in the Best Dividend Growth Stocks model portfolio.

This reaffirmation comes after an extensive recommendation process, where stocks are optimized based on their Returns Potential through dividend growth, Dividend Safety, with considerations for Returns Risk and Yield Attractiveness. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 16, 2023.

Our in-depth stock analysis that follows connects these intriguing teaser insights, unpacking the layers that make this stock a compelling piece of the dividend investor’s puzzle. From financial health, sector position, to dividend history, and payout ratios, we delve into why this stock deserves its esteemed place in portfolios oriented toward both growth and stability.