For dividend growth investors seeking a stable addition to their portfolio, a noteworthy large-cap Cons. Stpl Distributors stock has been recently included in the Best Dividend Growth Stocks model portfolio. This inclusion is based on several key financial indicators that suggest a solid dividend growth potential.

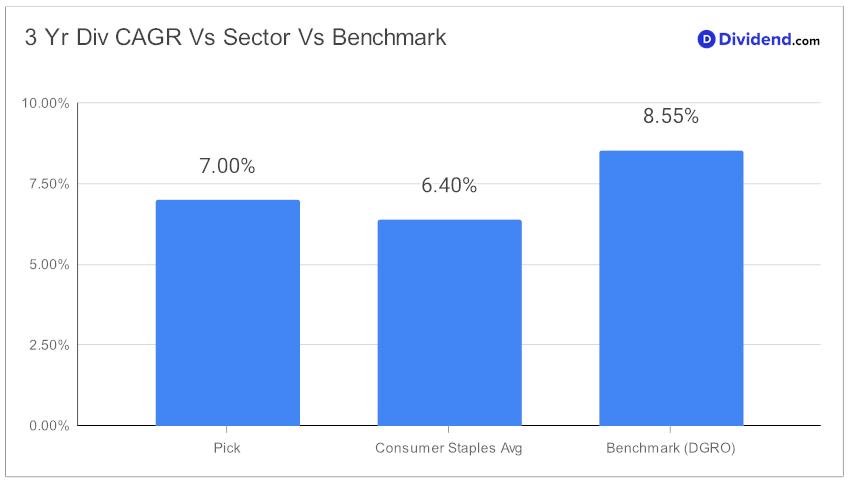

The stock’s forward payout ratio is at 27%, closely mirroring the industry average of 25%. Notably, it has a 51-year history of consistent dividend increases, positioning it in the top 10% of dividend stocks. This consistency indicates a reliable dividend growth pattern. Additionally, its three-year dividend/shr compound annual growth rate of 7% ranks it in the upper 40% of all dividend stocks, showcasing a steady growth in shareholder returns.

A beta of 0.78 suggests that the stock’s monthly returns are less correlated with the broader equity markets, potentially offering diversification benefits to an investment portfolio. This aspect is particularly significant for investors who prioritize return potential and dividend safety.

Investors should note the next estimated dividend payout of $0.450/shr, expected around February 2nd. This upcoming dividend is reflective of the company’s commitment to maintaining and growing shareholder returns.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 25, 2023. An in-depth analysis will follow, providing further insights into the stock’s financial health and prospects, valuable for those considering it as a part of their dividend growth investment strategy.