Introducing a new addition to our Best Dividend Growth Stocks model portfolio: a well-covered mid-cap Banking stock that has been making waves in the investment world. This stock boasts a forward payout ratio of 28%, which is not only low but also aligns with the banking average of 37%.

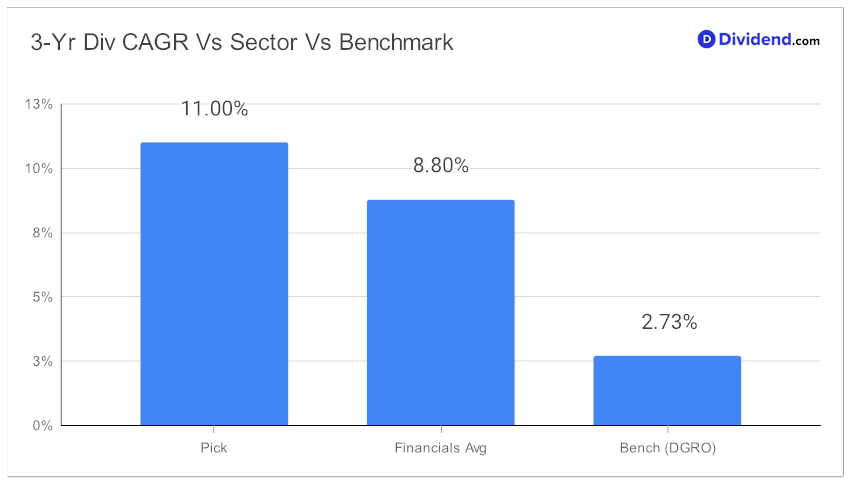

Over the past three years, this stock has shown a commendable 11% dividend per share compound annual growth rate, placing it in the top 40% of all dividend stocks. This impressive performance is a testament to the company’s commitment to delivering consistent and robust growth to its investors.

The next payout is an unchanged qualified $0.550 per share, which is going ex-div tomorrow (Sep 7). This is an opportunity for investors to reap the benefits of their investment and witness the growth potential of this stock.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on July 27, 2023.

Our recommendation process is designed to optimize for Returns Potential via dividend growth and then Dividend Safety. We also consider Returns Risk and Yield Attractiveness to a lesser extent.

Stay tuned for an in-depth stock analysis that will provide a comprehensive overview of this promising addition to our portfolio. This analysis will delve into the stock’s performance, its potential for future growth, and why it deserves a spot in your investment portfolio.