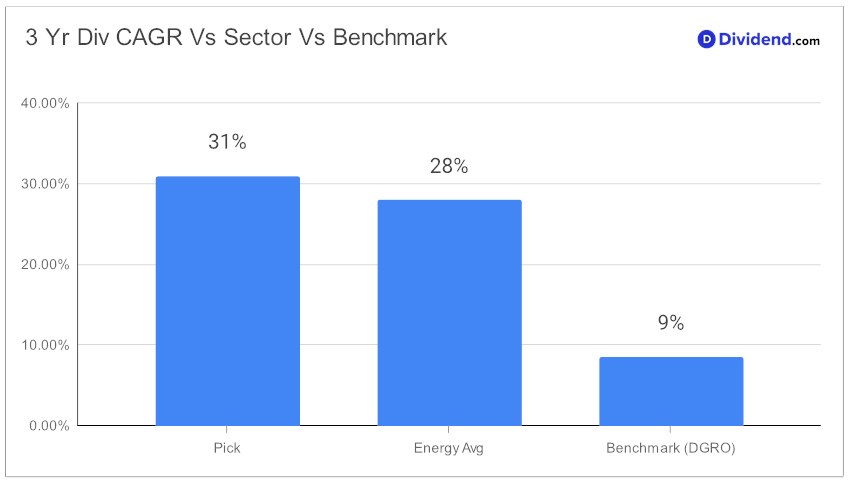

In the ever-evolving landscape of dividend growth investing, a well-covered large-cap player in the energy sector has recently been added to a prestigious model portfolio, signaling a compelling opportunity for investors focused on sustainable income and growth. With a payout ratio comfortably set at 30%, this stock mirrors the industry’s average yet stands out for its commendable track record of dividend increases over the past seven years—placing it in the top 30% of dividend stocks and hinting at promising prospects for future hikes. Its remarkable 3-year dividend compound annual growth rate (CAGR) of 31% further cements its position in the top echelon of dividend payers, underscoring its potential for robust returns.

Investors should note the upcoming dividend payout, estimated at $0.910 per share, scheduled for on or around February 23rd. This development is part of a broader investment strategy that prioritizes not just the returns potential through dividend growth but also dividend safety, with considerations for returns risk and yield attractiveness.

This addition to the model portfolio is grounded in meticulous analysis, focusing on generating sustained returns for dividend growth investors. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 3, 2023.

The following in-depth stock analysis will delve deeper into the metrics that make this stock a notable contender for those seeking to optimize their investment outcomes in the dividend growth space.