In the ever-evolving landscape of dividend investing, a new beacon shines brightly within the Best Sector Dividend Stocks model portfolio. This latest addition emerges as a well-covered large-cap stock in the Consumer Products sector, presenting a compelling case for balanced dividend investors seeking stability and growth. With a modest 44% forward payout ratio aligning closely with the sector’s average, it demonstrates both financial health and a commitment to returning value to shareholders. Notably, its 12-year streak of dividend increases places it in the elite top 10% of dividend growth stocks, with expectations of continued upward adjustments.

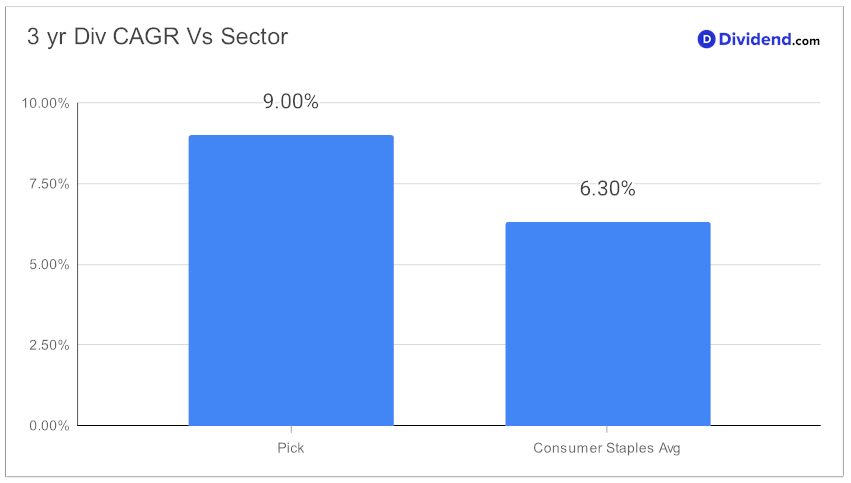

The stock’s three-year dividend compound annual growth rate of 9% secures its position in the top 40% of its peers, offering an appealing blend of yield, safety, and growth potential. Moreover, its low beta of 0.58 signals lesser correlation with broader equity market swings, enhancing portfolio diversification.

Investors should take note of the upcoming unchanged dividend payout of $0.425 per share, going ex-dividend next Wednesday, offering an immediate opportunity for potential income.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 31 Jan, 2024. The global snack food manufacturer reported its most successful year in 2023, achieving record revenue, profitability, and shareholder returns amidst challenging market conditions. The company’s financial growth was primarily driven by effective pricing strategies and strong consumer engagement with its products. Despite facing inflation, changing consumer behaviors, and geopolitical tensions, it generated significant gross profit and free cash flow, allowing for reinvestment in brand and capability enhancement.

Looking forward, the company remains optimistic, expecting robust earnings per share growth in 2024 while continuing to navigate industry challenges such as cost inflation and currency volatility, maintaining a strong commitment to brand support and sustainability initiatives.

This addition to the portfolio has been carefully selected based on an equal blend of yield, dividend safety, returns potential, and risk, specific to the Consumer Staples sector. The following in-depth analysis delves into these aspects, offering a comprehensive look at why this stock stands out as a prime choice for those aiming to balance risk and reward in their dividend investment strategy.