In the dynamic world of dividend investing, a standout mid-cap Consumer Products stock is making waves. With a remarkable 13-year streak of dividend increases, placing it in the top 10% of dividend stocks, this company exemplifies stability and growth potential. Unlike its peers, it has managed a commendable 5% year-to-date return, outperforming the broader S&P 500 and eclipsing the Consumer Products industry’s average.

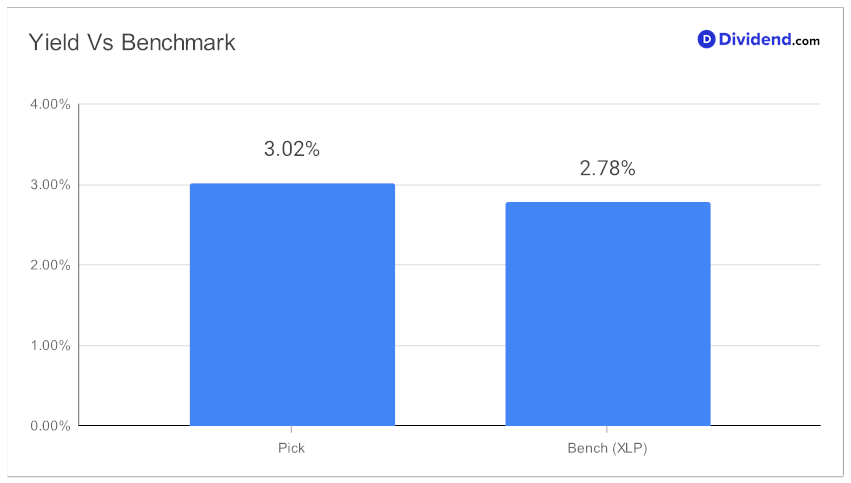

What makes this stock a compelling choice for balanced dividend investors? The answer lies in its well-strategized balance between yield, dividend safety, return potential, and risk management, specifically tailored for those invested in the Consumer Staples sector. As we delve deeper into its performance metrics, one cannot overlook the upcoming dividend payout—an estimated $0.780 per share, expected on or around December 15. The stock currently yields 3.02%, slightly better than that of this portfolio’s benchmark.

This teaser is just the tip of the iceberg.

The in-depth analysis that follows will unpack the strategic recommendation process behind this addition to the Best Sector Dividend Stocks model portfolio, providing a comprehensive view of why this stock is a must-consider for investors seeking a blend of steady income and growth potential in a volatile market. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 8, 2023.

Stay tuned for an insightful exploration into this promising investment opportunity.