In the realm of dividend investing, a new contender emerges, seamlessly blending reliability with growth potential in the Consumer Discretionary sector. This large-cap Home/Office Products stock stands out for its prudent financial management, evidenced by a modest 37% forward payout ratio—aligning closely with the sector’s average. Notably, its 14-year streak of dividend increases places it in the elite top 10% of dividend stocks, hinting at a stable foundation for future growth.

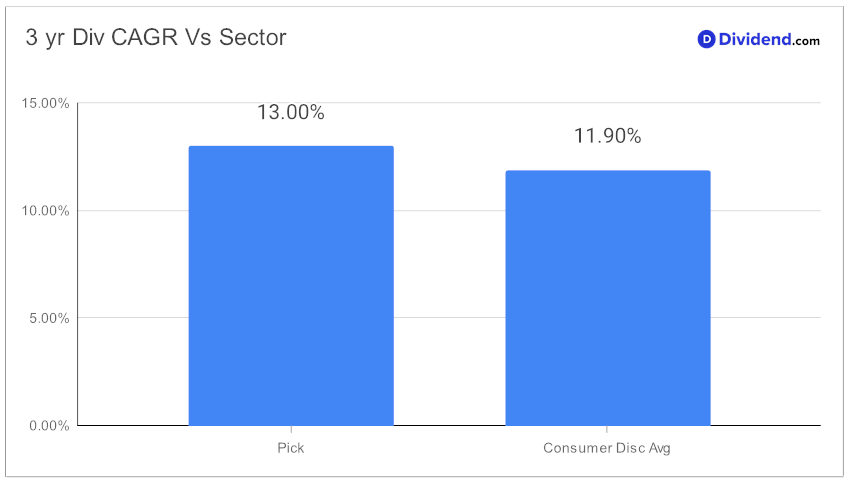

With a commendable 13% 3-year dividend per share compound annual growth rate, it ranks in the top 20%, showcasing its commitment to rewarding shareholders.

Investors will be pleased to learn of the upcoming dividend payout, estimated at $1.860 per share on or around February 9, underscoring the stock’s appeal to those seeking steady income streams.

This selection, part of the Best Sector Dividend Stocks model portfolio, was meticulously chosen for its balanced approach, optimizing yield, dividend safety, return potential, and risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 9, 2024.

The full analysis that follows dives deeper into why this stock represents a compelling addition to a balanced dividend investor’s portfolio, illuminating its strategic positioning for both stability and growth.