Investors seeking a robust addition to their portfolio may consider the latest holding in the Best Sector Dividend Stocks model portfolio. This well-covered large-cap Consumer Discretionary Retail stock offers a promising forward payout ratio of 40%, aligning with the sector’s average of 32%.

With an impressive 68-year dividend increase track record that ranks in the top 10% of dividend stocks, and future increases expected, it’s an attractive option for balanced dividend investors.

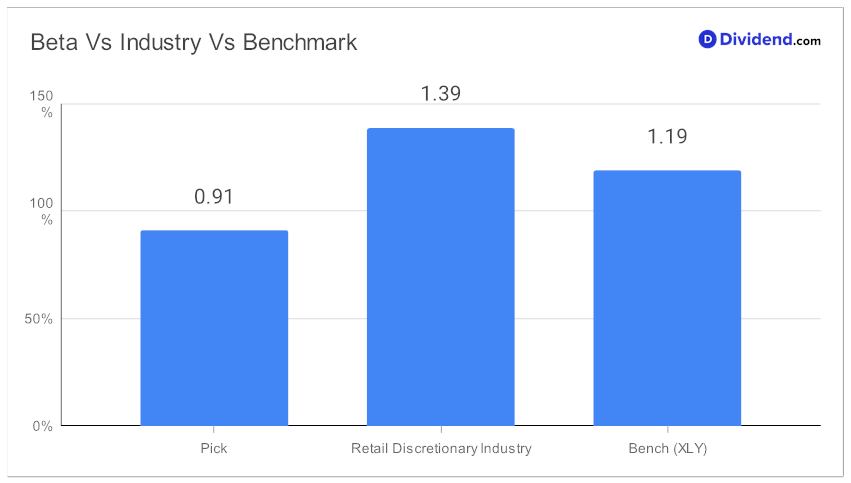

The stock’s beta of 0.91 ensures that monthly returns aren’t tightly correlated with equity markets, adding an element of diversification.

Look out for the next estimated payout of $0.950 per share on or around August 15.

While forming our recommendation, we’ve also factored in key growth drivers and financial performance discussed by the company’s management during its Q2 earnings call held on July 21, 2023.

The recommendation process focused on an equal blend of yield, dividend safety, returns potential, and risk within the Consumer Discretionary dividend stocks. Stay tuned for the in-depth stock analysis that delves into the details of this promising holding.