In the dynamic landscape of dividend investing, a mid-cap Consumer Services stock stands out as a compelling addition to the Best Sector Dividend Stocks model portfolio. This addition marks a significant opportunity for balanced dividend investors, offering a rare blend of stable income and growth potential. With a forward payout ratio of 32%, it aligns closely with the industry average, signaling both sustainability and room for growth.

Impressively, this stock boasts a 13-year streak of dividend increases, placing it in the top 10% of dividend stocks. This track record, combined with expectations of future hikes, makes it a standout choice for investors seeking reliable income streams. Moreover, its 13% three-year dividend compound annual growth rate further underscores its appeal, ranking in the top 40% of all dividend stocks.

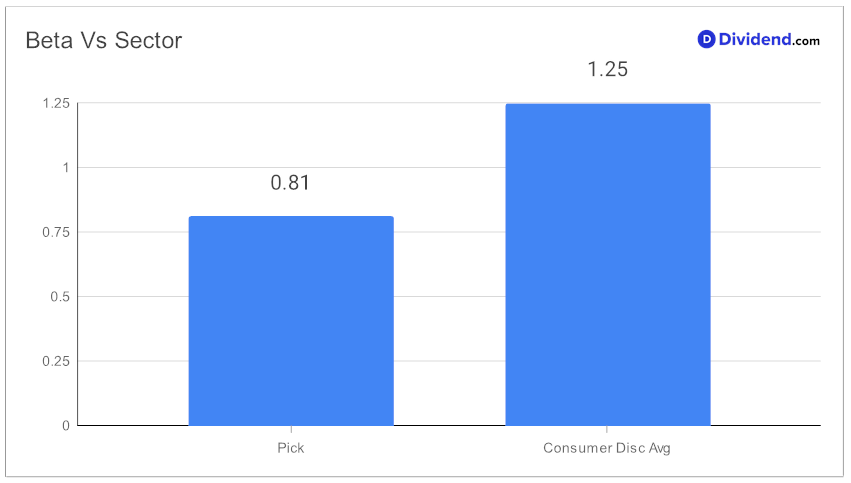

The stock features a beta of 0.81, suggesting less volatility compared to the broader market and the consumer discretionary sector.

As investors look ahead, the next payout is particularly noteworthy. An unchanged qualified dividend of $0.290 per share is set to go ex-dividend tomorrow, December 14, providing an immediate benefit for shareholders. This payout, consistent with the company’s history of regular dividends, reinforces its commitment to shareholder returns.

For those seeking an in-depth understanding of this investment opportunity, a comprehensive analysis follows. It delves into the company’s performance, dividend safety, return potential, and risk profile. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 2, 2023.

This analysis is tailored specifically for those aiming to optimize their portfolio with a balanced mix of yield, dividend safety, returns potential, and risk within the Consumer Discretionary sector.