In the ever-changing landscape of the stock market, one newly added holding stands out in the Best Sector Dividend Stocks model portfolio. This company, a dominant player in the Gaming/Lodging/Restaurant industry, is a fortress of financial stability and a magnet for dividend hunters. With a remarkable 40+ year track record of consistent dividend increases, this stock sits comfortably in the top 10% of all dividend-yielding stocks. Future dividend increases are also projected, which is a promising sign for balanced dividend investors seeking reliable income.

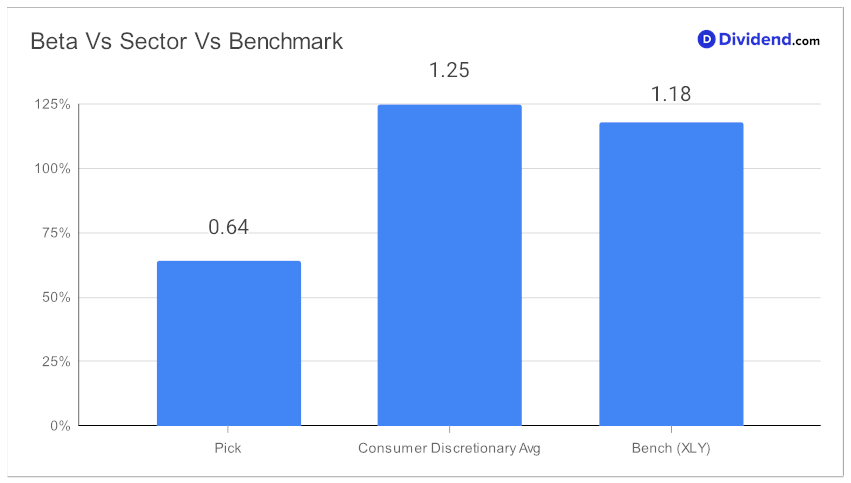

Diversification is crucial, and this addition addresses that need perfectly. With a 0.64 beta, the stock’s monthly returns demonstrate low correlation to the broader equity markets. This uncorrelated behavior serves as a diversifying asset within an equity-focused portfolio, making it a strategic pick for those aiming for a balanced investment approach.

When it comes to immediate returns, investors have something to look forward to. An estimated next payout of $1.520 per share is scheduled for on or around October 13. This payout further substantiates the stock’s commitment to shareholder value.

For those intrigued by this compelling addition, stay tuned for an in-depth stock analysis that will delve into optimizing for an equal blend of yield, dividend safety, returns potential, and risk, but exclusively within the realm of Consumer Discretionary dividend stocks. We have also taken into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on July 27, 2023.

Make sure to consult this exhaustive analysis to make a well-informed decision.