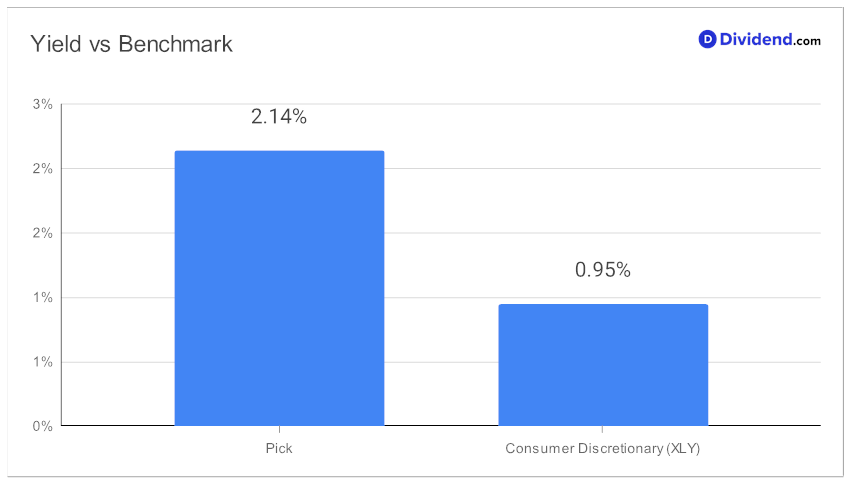

Discover an invigorating new addition to the Best Sector Dividend Stocks model portfolio—a high performing pick with a laudable 12-year track record of dividend increases, placing it in the elite top 10% of dividend stocks. Additionally, its above sector-average forward yield of 2.14% places it ahead of its peers within the consumer discretionary sector.

It’s a champion in the Consumer Discretionary sector, known for its resilience and reliability. This well-covered large-cap Gaming/Lodging/Restaurant stock also boasts a 19% 3-year dividend per share compounded annual growth rate, placing it amongst the top 40% of all dividend stocks.

Next in line is an attractive payout: an unchanged qualified dividend of $0.530 per share, going ex-dividend on August 10.

Our rigorous selection process ensures a balanced blend of yield, dividend safety, potential returns, and risk, paving the way for a rewarding investment journey. Dig deeper into our in-depth stock analysis to uncover the full potential of this thriving asset, and understand why it’s a must-have in your dividend portfolio.