The Federal Reserve may be reducing the magnitude of its interest rate hikes in response to slowing inflation, but there’s still a long road before it reaches its 2% inflation target. In addition, central bankers worry that politicians will respond to the economic pain of higher interest rates with a boost to public spending, undermining their efforts.

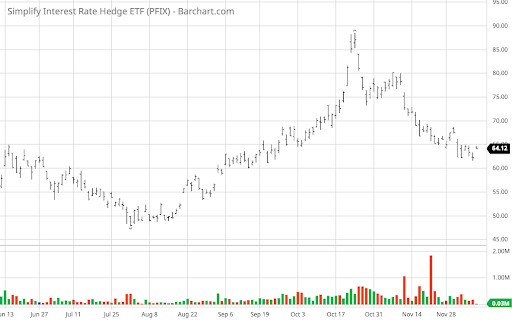

Several strategies, such as investing in commodities, can help investors hedge against rising interest rates. But the actively managed Simplify Interest Rate Hedge ETF (PFIX) is one of the few ETFs that provide a simple and transparent way to hedge against interest rate risk.

Let’s examine why inflation isn’t going away anytime soon and why you might want to consider the PFIX to hedge your portfolio.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Interest Rates Could Reach 5% by June 2023

Federal Reserve Chairman Jerome Powell indicated that the central bank would slow the pace of interest rate increases in December, providing some respite to investors. But, in the same comments, he also stressed that borrowing costs would need to keep rising and remain restrictive for some time to beat inflation. In other words, rate hikes are far from over.

Rate hike probabilities over upcoming Fed meetings. Source: FedWatch

Currently, the Fed Funds Rate stands at a 425 to 450 basis point range following December 2022’s meeting, wherein the rate was raised by another 50 basis points. However, by June 2023, the CME FedWatch tool—which analyzes the futures market to make predictions—projects that interest rates could reach a 475 to 500 basis point range. That means there could be a lot more pain ahead.

The only factor that could stop rising interest rates is a deep recession. If economic growth sharply slows, the central bank may have to slow the pace of its interest rate increases or even reverse course. As a result, investors should keep a close eye on economic indicators for signs of a steeper-than-expected slowdown.

Hedging With the Simplify Interest Rate Hedge ETF

Investors have many options when hedging their portfolios against rising interest rates. For example, many investors add commodities, like gold or crude oil, to their portfolios because they tend to be more inflation-resistant. Other investors allocate more to inflation-resistant industries or assets, like real estate or senior, secured bank loans.

The Simplify Interest Rate Hedge ETF (PFIX) is one of the few ETFs that provide a simple and transparent direct hedge against interest rates. Rather than investing in assets that tend to move higher when interest rates rise, the fund invests primarily in over-the-counter interest rate options that move in lock-step with interest rates.

Under the hood, the fund invests in institutional over-the-counter (OTC) derivatives that are functionally similar to owning a position in a long-dated put option on 20-year Treasury bonds. The position provides strategic exposure to interest rates while minimizing the cost of ownership and maximizing convexity or sensitivity to changes in interest rates.

Since the beginning of the year, the fund has risen more than 60%, outperforming many other inflation hedges. And with interest rates expected to increase through June 2023, the fund could have more room to run through the first half of next year. And finally, its 0.50% expense ratio makes it very reasonable from a cost standpoint.

The Bottom Line

Inflation and rising interest rates aren’t going away anytime soon, and the Simplify Interest Rate Hedge ETF (PFIX) provides a simple and direct hedge. While the ETF is already up more than 60% since January, expectations for rising interest rates through June 2023 could mean the fund has more upside potential ahead.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.