Income investors don’t have to look far for yields that were impossible to find just a few years ago – even the safest money market accounts offer 5% yields! But with ultra-safe yields so high, it’s becoming a challenge for many fixed-income funds to compete. Meanwhile, income investors must ensure these yields are sufficient to overcome cost of living inflation.

In this article, we’ll look at why you may want to consider active fixed-income ETFs and three potential candidates for your portfolio.

Why Choose Active Funds?

The active versus passive debate occurring in the equity markets is flipped in fixed-income markets. Historically, most actively managed fixed-income funds have outperformed their benchmark indices across several categories. For instance, Fidelity researchers found that outperformance in some corners of the market exceeds 90% of managers!

| Bond Type | 1 Year | 3 Year | 5 Year | 10 Year |

|---|---|---|---|---|

| Short-term Bond | 75% | 60% | 77% | 72% |

| Intermediate-core Bond | 61% | 68% | 75% | 74% |

| Intermediate-core-plus Bond | 83% | 79% | 89% | 90% |

| Multisector Bond | 94% | 69% | 90% | 91% |

Data as of December 31, 2021. Source: Fidelity

Experienced managers look at macroeconomic, fundamental and quantitative factors to build a portfolio better equipped to weather market downturns. But at the same time, they have the flexibility to take advantage of the wide dispersion of bond market returns by looking at everything from credit quality to payment structures.

3 High-Yield Active Bond ETFs

Investors have many options when looking for active fixed-income ETFs, but those looking for income may want to focus on high-yield bonds. While these bonds are riskier than a core portfolio, active managers can help diversify away many of these risks by constructing a portfolio spanning many sectors, maturities and rates.

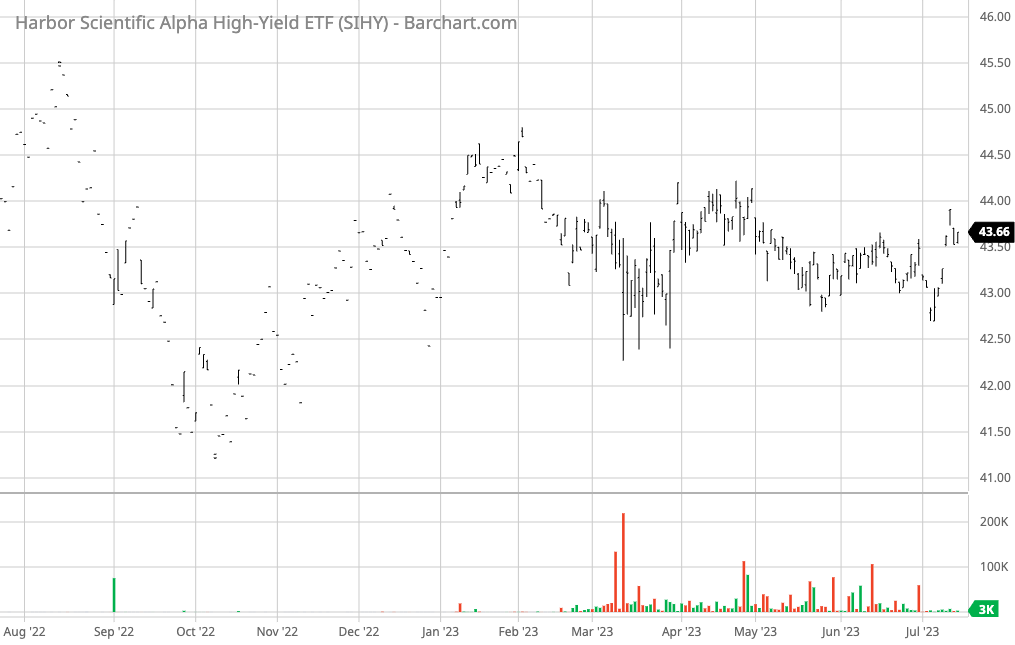

Harbor Scientific Alpha High-Yield ETF (SIHY)

The Harbor Scientific Alpha High-Yield ETF (SIHY) uses an evidence-based, data-driven, economically-intuitive, and grounded approach to build an optimized fixed-income portfolio. In particular, the fund invests in a diversified portfolio of high-yield corporate bonds with a low correlation to traditionally managed active high-yield strategies.

Source: Barchart.com

Currently, the newly launched fund holds a concentrated portfolio of 160 bonds and offers an 8.32% effective 30-day SEC yield with monthly distributions. These bonds have a weighted average maturity of five years and an average market coupon of 5.56% and include names like Unicredit, Hilton, New Fortress Energy, and Live Nation Entertainment.

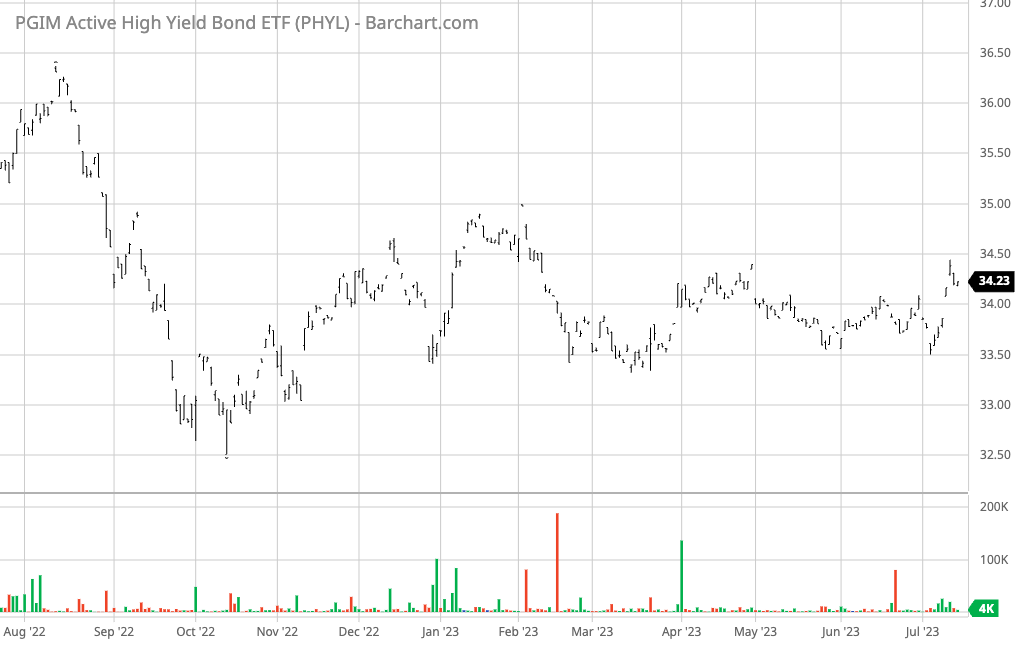

PGIM Active High-Yield Bond ETF (PHYL)

The PGIM Active High-Yield Bond ETF (PHYL) invests in high-yield bonds using top-down

economic analysis and bottom-up research in conjunction with proprietary quantitative models and risk management systems. The managers may also look at total return, spread, price appreciation potential, and other factors to build an optimal portfolio.

Source: Barchart.com

While the SIHY has a limited track record, PHYL beat its benchmark in 2019, 2020, 2021 and over the year-to-date timeframe. The fund offers an 8.30% SEC yield and monthly distributions, making it a compelling option for fixed-income investors. Meanwhile, its portfolio is weighted toward health care, gaming and cable/satellite companies.

American Century Select High-Yield ETF (AHYB)

The American Century Select High-Yield ETF (AHYB) is a third option offering active exposure

to high-yield bonds. By investing primarily in BB and B-rated bonds, the fund seeks to achieve lower volatility and higher risk-adjusted returns than traditional high-yield funds. Like the previous two funds, the managers take a top-down and bottom-up approach.

Source: Barchart.com

Currently, the fund holds a diverse portfolio of 473 bonds with a 7.44% SEC yield and monthly distributions. These bonds have a 3.64-year adjusted duration and a 5.58% weighted average coupon. And while it’s a newer fund, it has outperformed its benchmark so far this year with a 6.23% total return versus a 5.73% benchmark return.

The Bottom Line

Active managers offer a proven track record in fixed-income markets. If you’re looking for higher yields, the three funds on our list combine active management with high-yield issuers to deliver higher monthly income than ultra-safe alternatives with potentially safer holdings or more traditional active or passive high-yield fixed-income ETFs.

Explore all high-yield bond mutual funds, indexed ETFs and active ETFs here.