Socially responsible investing (SRI) has become increasingly popular over the past decade. According to Ernst & Young, investors in their 20s and 30s are almost twice as likely to put their money into companies or funds targeting positive environmental or social outcomes. Nearly one third of Millennials also seek values-based financial advisors.

Of course, these funds take a variety of approaches when building out their portfolios. For example, some SRI funds exclude adult entertainment, alcohol, firearms, fossil fuels, GMO foods, nuclear power, and tobacco. Meanwhile, others focus on issues like gender or racial equality in the boardroom or workforce diversity.

OneAscent Investment Solutions recently launched two new exchange-traded funds that apply SRI criteria to international investment opportunities, enabling investors to align their portfolios and values when adding targeted international exposure.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

OneAscent’s SRI Approach

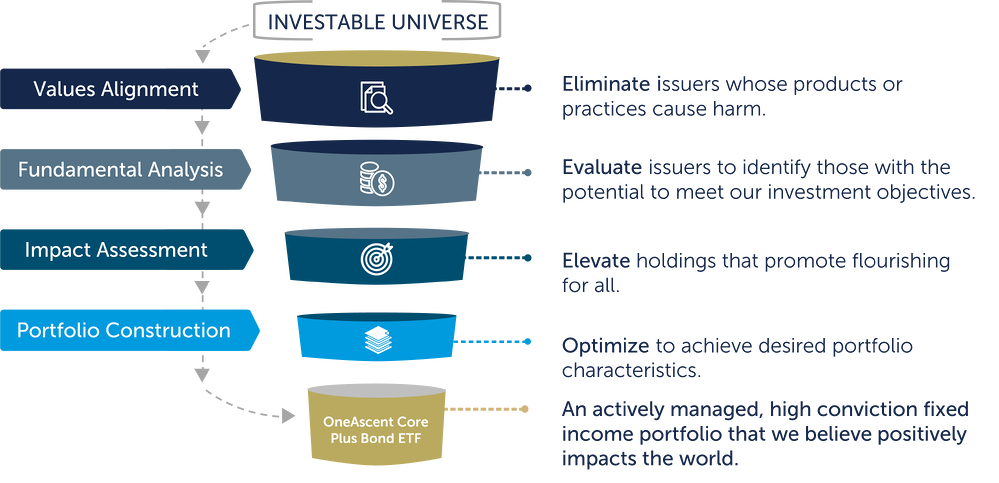

OneAscent’s actively-managed ETFs use a proprietary process to select portfolio components. This process involves an extensive fundamental analysis that dives deep into a company’s business model, stakeholder policies, and overall community impact. The goal is to go beyond surface-level screening and apply more rigorous selection criteria.

The fund managers begin by applying a values-based screening that includes:

- Involvement in abortion

- Production or distribution of addictive products

- Predatory lending practices

- Human rights violations

- Patterns of severe ethical controversies

Then, the managers seek out companies that promote specific values, including:

- Unmet and underserved marketplace needs

- Purposeful vocations and meaningful work* Fostering vibrant communities

- Embracing a partnership and spirit of collaboration

- Cultivating natural resources

- Enhancing well-being and human experience

Finally, the fund managers evaluate companies that pass both screens within the context of a natural corporate lifecycle and use quantitative and fundamental ‘bottom-up’ research to identify those capable of generating sustainable returns on investment.

What’s in the Portfolios?

OneAscent’s actively-managed approach provides managers with a lot of flexibility when building portfolios.

Currently, the OneAscent International Equity ETF (OAIM) holds about 40 mostly international equities concentrated in industrials (24%), financial services (21%), and technology (19%). The portfolio’s largest holdings include DBS Group Holdings Ltd. (4%), Nestle SA (4%), Element Fleet Management Corp. (4%), and KBC Group (4%).

The OneAscent Emerging Markets ETF (OAEM) also holds a portfolio of about 40 international equities concentrated in technology (37%), financial services (29%), and consumer defensive (12%). The largest holdings include Samsung Electronics Co. (7%), PT Bank Rakyat Indonesia (5%), and Taiwan Semiconductor Manufacturing Co. (5%).

The ETFs have adjusted expense ratios of 0.95% and 1.25%, respectively.

Alternatives to Consider

Investors have many options when building socially responsible portfolios. When choosing between these options, investors should consider the exclusionary or inclusionary screening criteria, expense ratios and fees, and the overall portfolio’s risk/reward profile.

Some popular international SRI-focused ETFs include:

| Name | Ticker | AUM | Expense Ratio |

| Vanguard ESG International Stock ETF | VSGX | $3.04 billion | 0.12% |

| Nuveen ESG International Developed Markets Equity ETF | NUDM | $0.24 billion | 0.30% |

Data as of November 3, 2022.

The Bottom Line

OneAscent’s new SRI-focused international ETFs help investors who want to align their portfolio with their values add global exposure to their portfolios. Unlike many other U.S. or globally-focused SRI ETFs, OneAscent’s ETFs offer specific exposure to international or emerging markets through an SRI lens.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.