Active ETFs continue to attract record capital inflows as investors seek lower-cost alternatives to mutual funds. At the same time, active funds offer investors a way to generate alpha through innovative new strategies, particularly in today’s bear market. And with so many new fund launches, investors have never had more options.

Let’s look at five newly launched active ETFs that you may want to consider for your portfolio.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

1. NEOS Enhanced Income Aggregate Bond ETF (BNDI)

The NEOS Enhanced Income Aggregate Bond ETF (BNDI) applies an active approach to the U.S. Aggregate Bond Index, seeking less sensitivity to credit and duration risk using an integrated option strategy. As a result, the fund aims to provide tax-efficient monthly income that exceeds bond interest payments alone.

Like many ETFs, the fund converts bond interest into qualified dividend income via its ETF wrapper, but it also applies a data-driven put option strategy to manage risk. The active nature of the fund also enables it to take advantage of tax loss harvesting opportunities while using 1256 option contracts to reduce the impact of taxes on returns.

2. BlackRock Future Financial & Technology ETF (BPAY)

The BlackRock Future Financial & Technology ETF (BPAY) is an actively-managed fund that invests in companies delivering innovative and emerging financial services technologies. In particular, the fund’s managers seek out companies disrupting payments, banking, investments, insurance, and financial software.

The ETF holds a concentrated portfolio of about 40 companies, including roughly half software and half financial businesses. As a result, investors will own a combination of conventional financial institutions, like JPMorgan, and software companies, like PayPal or Block, blending value with growth potential.

3. Innovator Uncapped Accelerated U.S. Equity ETF (XUSP)

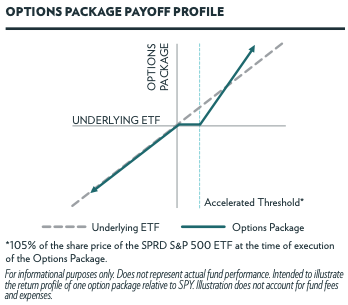

The Innovator Uncapped Accelerated U.S. Equity ETF (XUSP) seeks to outperform the S&P 500 index using a rules-based option strategy. In particular, the fund managers use a 12-month options overlay for uncapped upside acceleration. Investors forgo a portion of single-digit returns in exchange for potentially accelerated upside.

The fund managers believe that advisors could use the ETF within the core of any equity portfolio in place of mandates to active stock fund managers over the long term. In addition, it could be helpful from a tactical standpoint to express a bullish view on the prospects for domestic large-cap stocks.

4. Invesco Agriculture Commodity Strategy No K-1 ETF (PDBA)

The Invesco Agriculture Commodity Strategy No K-1 ETF (PDBA) is an actively-managed fund that invests in commodity futures, commodity-linked futures, and collateral. The fund seeks to outperform the DBIQ Diversified Agriculture Excess Return Index, which consists of futures contracts of the 11 most actively traded global agriculture commodities.

Currently, the fund’s largest holdings include:

- Corn Futures – 13.96%

- Soybean Futures – 13.33%

- Wheat Futures – 13.09%

5. NEOS S&P 500 High Income ETF (SPYI)

The NEOS S&P 500 High Income ETF (SPYI) is an actively-managed fund that aims to deliver attractive monthly distributions. After replicating the S&P 500 index, the team implements a data-driven option overlay strategy that uses a call spread approach to generate monthly income, tax efficiency, and potential equity upside.

Unlike passive covered call strategies, the fund managers use SPX index options classified as Section 1256 contracts, enabling them to take advantage of tax loss harvesting opportunities. The long-short nature of these contracts also means that the fund may provide outperformance in mildly bullish or bearish environments.

The Bottom Line

Active ETFs have become increasingly popular to lower costs and generate alpha. With new funds launching every month, investors may want to keep an eye on opportunities to achieve their goals. These five new active ETFs may fit the bill for some investors.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.