It’s been an interesting time for the fixed income world over the last year or so. The normally sleepy sector has quickly become a hotbed of volatility, and those gyrations have come to roost in the world of staid Treasury bonds and notes as well. For fixed income investors tracking the Bloomberg Aggregate, it has resulted in a slight loss for the year.

But for investors looking towards active management, the volatility could be a blessing in disguise.

At least that’s the gist according to asset manager John Hancock. And with that, now is a great time for investors to take a look at active ETFs for their fixed income portfolios. By adding the benefits of ETFs, it’s a win-win for bond investors.

Rising Volatility

Investors generally buy bonds because they are boring. Aside from certain corners of the fixed income market such as bank loans and junk, bonds generally feature low volatility. Investors buy them for their steady coupon rates. But lately, even Treasuries and bread-and-butter corporate bonds are starting to see some serious movement about yield and price.

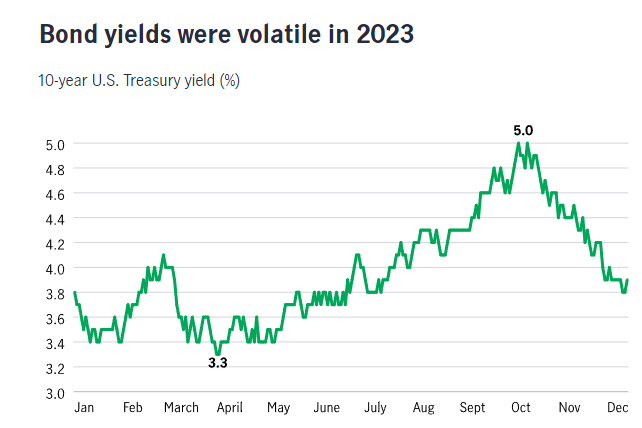

Starting with the uncertainty surrounding interest rate policies and inflation, bonds have spent much of the last year or so moving around. You can see that in the yield of the 10-year Treasury. Considered the benchmark bond, many other yields play off of the 10-year bond. Over the last four quarters or so, it’s been anything but smooth.

This chart from asset manager John Hancock shows the bounciness of the 10-year bond’s yield. And because yield is also tied to price, we can infer that bond prices have also seen such waves. 1

Source: John Hancock

For investors looking to own bonds, this volatility can throw a huge wrench in the machine’s cogs: stability of price and income goes right out the window. This is true when looking at returns. Today, the benchmark Bloomberg US Aggregate Bond Index (Agg) is sitting at a slight loss on the year – thanks to the volatility of yields.

Driving that volatility has been the uncertainty facing the Federal Reserve’s policy, growing Federal deficits, and concerns about economic health and growth. All of these issues don’t have quick fixes. As such, volatility across the fixed income landscape is set to continue, which makes being a bond index investor a jarring ride.

Why Active Now?

However, investors don’t have to be taken for a ride. At least not if they choose to be active within the fixed income space. According to John Hancock, today’s environment is just perfect for this space.

For starters, active management allows investors the ability to manage their duration risk to help calm volatility nerves. For example, lowering your duration to reduce losses during a rising rate environment or inversely adding duration during a falling one. But active managers can take that a step further and bet on anticipated rate changes ahead of time.

Today, this plays out by adding duration to a portfolio to bet on the eventual cut in interest rates. Active managers can add just a little duration to take advantage of those tailwinds but still protect against volatility and economic headwinds.

Secondly, active management can use recent volatility to add quality bonds on the cheap. The problem with indexing is that positions and allocations are static and standard, but active management doesn’t have to look like an index. Here, managers can do their own research and find bonds that are trading for discounts to their intrinsic values. This also extends itself to credit quality. For example, John Hancock highlights mortgage-backed securities as a prime example of quality that could be added outside of the Agg.

ETFs are Suited for Active Management

The truth is, the current environment doesn’t favor simply buying the Agg and then forgetting about it. There are too many uncertainties and overall volatility. Bond investors looking strictly for yield and stability may be out of luck. So, active management could be the real winner going forward.

And exchange traded funds (ETFs) are the way to do it.

Structurally, ETFs offer compelling “wins” for investors, including their ability to lower taxes versus other fund structures. Bonds by nature are a higher tax asset class with coupon payments coming at ordinary income rates. This can be as high as 39% for investors. Holding bonds in a mutual fund can expose investors to capital gains and the taxes that come with them – even if investors don’t sell their shares. However, thanks to their creation/redemption mechanism, ETFs can pass on those taxes. For active management – and its potentially greater trading/turnover ratios – this is a godsend for portfolios.

Secondly, it works on the quality side and value buys of managers. Bond ETFs can be fully invested, reducing cash drag. Here, managers can hold bonds until the principal is repaid or the markets fully appreciate the securities underlying values. And speaking of cash, quickly deploying fund assets into cash could save investors from losses while opportunities take form.

Finally, the low cost of management of ETFs makes it possible for investors to squeeze out every ounce of yield from a bond portfolio. When the Fed cuts or investors look towards lower durations, the ability of active ETFs to only charge a fraction of what active mutual funds do on expenses will mean more yield.

Active Bond ETFs

These ETFs were selected based on their low-cost exposure to active bond management. They are sorted by their YTD total return, which ranges from -2.8% to 2.8%. They have expenses between 0.18% and 0.70% and assets between $3B and $23B. They are currently yielding between 4.4% and 9%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| SRLN | SPDR Blackstone Senior Loan ETF | $4.36B | 2.8% | 9.0% | 0.70% | ETF | Yes |

| MINT | PIMCO Enhanced Short Maturity Active ETF | $9.7B | 2.2% | 5.1% | 0.35% | ETF | Yes |

| JPST | JPMorgan Ultra Short Income ETF | $22.8B | 1.9% | 5.4% | 0.18% | ETF | Yes |

| TOTL | SPDR DoubleLine Total Return Tactical ETF | $3.1B | -0.7% | 5.2% | 0.55% | ETF | Yes |

| BOND | PIMCO Active Bond ETF | $3.5B | -1.1% | 5.0% | 0.58% | ETF | Yes |

| DFCF | Dimensional Core Fixed Income ETF | $3.35B | -1.3% | 5.0% | 0.19% | ETF | Yes |

| FBND | Fidelity Total Bond ETF | $5.1B | -1.5% | 4.9% | 0.36% | ETF | Yes |

| FIXD | First Trust TCW Opportunistic Fixed Income ETF | $4.4B | -2.8% | 4.4% | 0.65% | ETF | Yes |

Overall, the increased volatility of yields has set fixed income investors for a major loop over the last few quarters. With many of the issues such as uncertain Fed policies and economic stagnation not abating, active management could have the upper hand versus passive strategies. And here, ETFs allow investors to get all the benefits of being active.

Bottom Line

Volatility is rising in the bond world, and that’s a huge issue for investors using the major bond benchmarks, as it removes much of the asset class’s stability. But active management and active ETFs could be the way to win out. Thanks to the fund structure’s unique benefits, investors using active ETFs for their fixed income assets should rise above the fray.