Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Verizon Communications and Realty Income, two strong dividend stocks, again trended this week. Realty has been the most popular ticker these past two weeks after the real estate company with an impressive track record of capital allocation announced an expansion into Continental Europe. Second in the list is Coca-Cola, which has suffered from the coronavirus pandemic but is on track for a strong recovery. Third in the list is cigarette-maker British American Tobacco, which recently won a patent lawsuit against arch-rival Phillip Morris International. The list is closed by Verizon.

Don’t forget to read our previous edition of trends here.

Realty Income

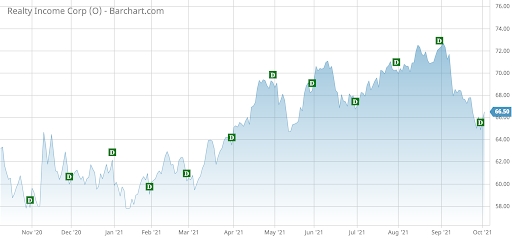

Realty Income (O) is the most popular dividend stock these past two weeks, seeing its viewership rise 31%. In the prior fortnight, Realty Income trended second after Microsoft.

Realty Income, a storied real estate company with an impressive track record in capital allocation and shareholder returns, is expanding into Continental Europe. Last month, the company announced a deal with French retailer Carrefour under which it closed a sale-leaseback transaction worth 93 million euros. Realty Income will become the owner of seven properties, which it will lease back to Carrefour as part of a long-term lease agreement.

The properties are located in Spain and mark the debut of Realty Income in Continental Europe. The company currently has a vast portfolio of real estate assets across the U.S. and the UK. Continental Europe could be Realty Income’s next growth driver, especially if the company uses the same strategy as it has implemented in other jurisdictions.

Realty Income typically partners with industry leaders and strong companies like Carrefour, which minimizes the risk that its tenants will miss rent payments.

Realty Income pays its dividend on a monthly basis and currently yields 4.3% per annum. The company has been raising its dividend for nearly 25 years.

Check out our latest Best Dividend Stocks List here.

Coca Cola

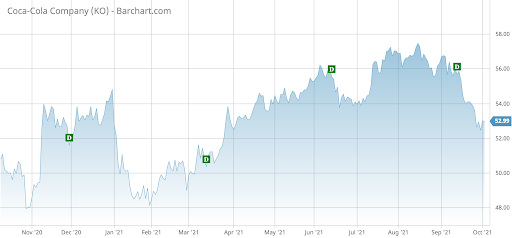

Beverages giant Coca-Cola (KO) has taken the second position in the list with an increase in viewership of 26%. Coca-Cola’s shares have suffered from the coronavirus pandemic as increased consumption at home failed to offset weak consumption in bars and restaurants. Changing hands at around $53 per share, the company’s stock has yet to reach pre-pandemic levels of $60. In 2020, the company’s revenues declined 11.4% to $33 billion, but recovered strongly in the first two quarters of the year, from around $7.5 billion in the June 2020 quarter to $10.1 billion in the same period in 2021. Meanwhile, net income surged 48% in the June 2021 quarter compared with the same period last year.

Although it has some of the best-selling sodas, investors might be worried about sugary beverages’ bad effects on consumers’ health. This could lead to weak growth or declining sales over the long term. To offset the fall in sales, Coca-Cola has launched new initiatives, including healthy alternatives like water, sports drinks, and plant-based drinks.

Coca-Cola’s dividend yields 3.2% and the company has been increasing its payouts to shareholders for nearly 60 years.

Use the Dividend Screener to find high-quality dividend stocks. Stocks with the highest Dividend.com Ratings are Dividend.com’s current recommendations to investors.

British American Tobacco

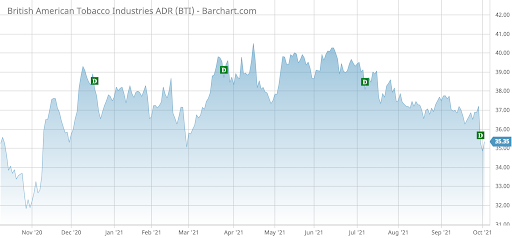

British American Tobacco (BTI) is third in the list with an increase in viewership of 13%. Last fortnight, Altria (MO), another tobacco company, was the fourth most trending stock.

British American Tobacco recently won an important legal victory against Altria’s international arm Phillip Morris International (PM). Late this summer, a judge ruled that Phillip Morris violated a patent held by British American Tobacco when it produced and marketed its highly successful product IQOS, a tobacco-heating device. British American was the first to invent a similar product in the 1990s but it never caught on with consumers.

Given the recent trend toward healthier alternatives to smoking, Phillip Morris was the first to commercialize IQOS and has had relatively strong success abroad. British American later launched a similar product named Glo but it remains behind IQOS.

With this victory in courts, Phillip Morris might be forced to license the technology from British American before transferring the rights to Altria for commercialization in the U.S. Indeed, Altria halted the expansion of IQOS in the U.S.

British American’s dividend yields an impressive 8.4% annually on a payout ratio of 66%. Its revenues increased from $14 billion in 2016 to $25 billion in 2020. Its shares, however, have lost more than 40% during the same period.

Verizon Communications

Verizon Communications (VZ) is trending last in the list these past two weeks, after trending third in the prior fortnight. Verizon recently unveiled in a virtual investor conference its potential next growth drivers.

The company said it will be laser-focused on improving its network and continuing to roll out its 5G capabilities. As part of this, Verizon hopes to nudge customers into buying higher-priced plans, which it expects to lead to 4% annual growth rates. Since 2016, Verizon came close to reaching the 4% growth rate target only in 2018.

Other revenue-boosting measures revealed by the company include new services like broadband, partnerships with content creators, and wholesale deals for 5G.

The Bottom Line

Realty Income is making its first foray into Continental Europe with a sales-leaseback agreement with giant French retailer Carrefour. Coca-Cola has seen its revenues recover dramatically following the coronavirus pandemic, but the stock is yet to reach pre-pandemic highs. British American Tobacco won an important court victory against its arch-rival Phillip Morris International. Verizon is hoping to reach 4% annual sales growth by selling high-priced 5G plans to customers.

Want to generate high income without undertaking too much risk? Check out our complete list of Best High Yield Stocks.