Inflation continues to reach multi-decade highs, but inflation-protected bond (TIPS) funds have had mixed performances. While Russia’s attack on Ukraine boosted the asset class, the Federal Reserve’s plans to aggressively increase interest rates and growing concerns over a recession could jeopardize performance.

For example, the iShares TIPS Bond ETF (TIP) is down more than 5% this year despite the consumer price index (CPI) accelerating to 8.5% in March 2022—the highest level since December 1981.

Let’s look at how TIPS work and better options for protecting your portfolio from the ravages of inflation.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

How Do TIPS Work?

Treasury inflation-protected securities, or TIPS, pay interest twice a year at a fixed rate. But unlike ordinary treasury securities, the principal increases with inflation and decreases with deflation, as measured by the CPI. As a result, the interest payments rise and fall depending on the inflation level at a given time.

While individual TIPS provide an inflation hedge, TIPS funds holding multiple TIPS react to interest rate expectations. If the market believes inflation will fall (e.g., due to rising interest rates), they will sell TIPS funds even though current inflation may be high. That’s why the iShares TIPS Bond ETF (TIP) fell despite the rising CPI.

TIP fell sharply when inflation was on the rise. Source: Google Finance

That said, conventional treasury bond funds don’t offer better performance in today’s market. For example, the Vanguard Intermediate-Term Treasury Index Fund ETF (VGIT) fell more than 6.5% this year—slightly worse than the TIP ETF. As a result, investors might have to look elsewhere for better inflation protection.

What’s Driving TIPS Lower?

Central banks raise interest rates to combat rising inflation. By increasing the cost of borrowing, these actions dampen spending and effectively force producers to lower their prices. But, of course, the drawback is that dampening spending could negatively impact the economy and even cause a recession if regulators aren’t careful.

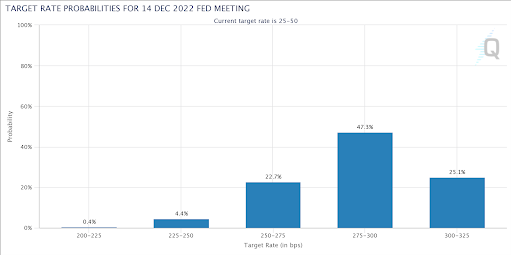

CME FedWatch projects interest rates will rise sharply in 2022. Source: CME FedWatch

The Federal Reserve is behind the curve when it comes to combating the current bout of inflation, but the central bank has aggressive plans to raise interest rates over the coming two years. In fact, the CME FedWatch anticipates that interest rates will reach a 275 to 300 basis point range after December 2022’s meeting—and possibly higher.

At the same time, the Federal Reserve’s plans to aggressively raise interest rates could increase the risk of a recession. In April, Goldman Sachs raised the odds of a recession to 15% in 12 months and 35% over the next 24 months. Even if there is no recession, the economy could still suffer and lower inflation expectations over time.

Alternatives to TIPS

Several TIPS alternatives may provide a more effective hedge against rising inflation.

Series I Savings Bonds, or I-Bonds, are arguably the best option, paying nearly 10% interest in today’s environment. Unlike TIPS, I-Bonds pay monthly interest, with interest rates that reset every six months. You can also cash them in before their maturity date—you only give up the last three months of interest (e.g., still a positive return).

Real estate and commodities are other popular options. For example, the SPDR Gold Trust (GLD) is up 5.43% this year, beating the TIP ETF by about 10%. While real estate ETFs have underperformed in recent months, they tend to outperform during rising interest rate environments since landlords can adjust rental rates higher.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

The Bottom Line

Treasury -inflation-protected securities may seem like an effective way to protect your portfolio against inflation, but in reality, they have underperformed during the past few months. As a result, investors may want to consider I-Bonds, gold, and real estate ETFs to hedge their portfolios and profit during inflationary environments.

Make sure to visit our News section to catch up with the latest news about income investing.